U.S. Manufacturing Output Increased for Sixth Month in October

- ByPolk & Associates

- Nov, 24, 2020

- Manufacturing

- Comments Off on U.S. Manufacturing Output Increased for Sixth Month in October

U.S. manufacturing production rose at a solid pace in October, marking the sixth straight advance as factories continued to recover from the depths of the pandemic-driven lockdowns earlier this year. Output at factories increased 1% from the prior month, matching the median forecast in a Bloomberg survey of economists, after an upwardly revised 0.1% gain […]

Hit the target with your email marketing

- ByPolk & Associates

- Nov, 13, 2020

- All News & Information

- Comments Off on Hit the target with your email marketing

Social media marketing tends to get plenty of attention these days, but email remains a viable medium for getting out the message of your business. And the COVID-19 pandemic is driving online shopping and sales. There are some basic ways to hit the target. Start with a catchy subject line. Next, write a headline that differs from the subject line but drives readers’ interest. Keep the body short and simple; tell customers why they should buy. Consider visual content, such as images and GIFs, but beware of some email systems’ limitations. Close with a call to action that includes a deadline and directions on what to do. Want help measuring and maximizing your marketing dollars? Contact us.

How Series EE savings bonds are taxed

- ByPolk & Associates

- Nov, 13, 2020

- All News & Information

- Comments Off on How Series EE savings bonds are taxed

Many people have Series EE savings bonds that were purchased many years ago. Perhaps they were given as gifts or maybe you bought them yourself and filed them away. You may wonder: How is the interest taxed? EE bonds don’t pay interest currently. Instead, accrued interest is reflected in their redemption value. (But owners can elect to have interest taxed annually.) EE bond interest isn’t subject to state income tax. And using the money for higher education may keep you from paying federal income tax on it. Unfortunately, the law doesn’t allow for the tax-free buildup of interest to continue forever. When the bonds reach final maturity, they stop earning interest. Contact us with questions.

Do you want to withdraw cash from your closely held corporation at a low tax cost?

- ByPolk & Associates

- Nov, 13, 2020

- All News & Information

- Comments Off on Do you want to withdraw cash from your closely held corporation at a low tax cost?

Owners of closely held corporations often want to withdraw money from their businesses at a low tax cost. The simplest way is to distribute cash as a dividend. However, a dividend distribution isn’t tax-efficient, since it’s taxable to you to the extent of your corporation’s “earnings and profits.” And it’s not deductible by the corporation. But there are alternatives that may allow you to withdraw cash and avoid dividend treatment. For example, you might be able to receive capital repayments, or obtain reasonable compensation for you, as well as certain fringe benefits. Contact us if you’d like to discuss these or other ideas to tax-efficiently get cash out of your corporation.

Should you go phishing with your employees?

- ByPolk & Associates

- Nov, 13, 2020

- All News & Information

- Comments Off on Should you go phishing with your employees?

As a business owner, you’re probably aware of the danger of “phishing.” This is when a fraudster sends a phony communication (usually an email) that appears to be from a reputable source but is really an attempt to get recipients to reveal sensitive information or expose their computers to malware. Ever considered trying it yourself? Many companies are intentionally sending fake emails to employees to determine how many will fall for the scams. But it’s hardly a risk-free strategy. You’ll need to budget for the costs of buying, installing and maintaining phishing simulation software. And you’ll have to consider the ethical implications of deceiving your employees. Contact us for more info.

Disability income: How is it taxed?

- ByPolk & Associates

- Nov, 13, 2020

- All News & Information

- Comments Off on Disability income: How is it taxed?

You may wonder if and how disability income is taxed. It depends on who paid for the benefit. If the income is paid directly to you by an employer, it’s taxable to you as ordinary salary would be. (Taxable benefits are also subject to federal tax withholding, although they may not be subject to Social Security tax.) Sometimes, payments aren’t made by an employer but by an insurance company under a policy providing disability coverage or other insurance. In this case, the tax treatment depends on who paid for the coverage. If an employer paid, the income is taxed to you just as if paid directly to you by the employer. But if it’s a policy you paid for, the payments you receive aren’t taxable.

Tax responsibilities if your business is closing amid the pandemic

- ByPolk & Associates

- Nov, 13, 2020

- All News & Information

- Comments Off on Tax responsibilities if your business is closing amid the pandemic

Unfortunately, COVID-19 has forced many businesses to shut down. If this is your situation, we’re here to assist you in any way we can, including taking care of various tax obligations. A business must file a final income tax return and some other related forms for the year it closes. If you have employees, you must pay them final wages and compensation owed, make final federal tax deposits and report employment taxes. Failure to withhold or deposit employee income, Social Security and Medicare taxes can result in personal liability for what’s known as the Trust Fund Recovery Penalty. There may be other responsibilities. Contact us to discuss these issues and to get answers to any questions.

Now more than ever, carefully track payroll records

- ByPolk & Associates

- Oct, 30, 2020

- All News & Information

- Comments Off on Now more than ever, carefully track payroll records

Payroll recordkeeping was important in the “old normal,” but it’s even more important now as businesses continue to navigate their way through a slowly recovering economy and continuing COVID-19 pandemic. Under the “records-in-general” rule, most employers must keep information relating to federal income, Social Security and Medicare taxes for at least four years after the due date of an employee’s personal income tax return (generally, April 15) for the year in which the payment was made. A variety of data and documents fall under the rule, including employees’ personal identification data (such as Social Security numbers) and their compensation amounts. Contact us for more information.

Divorcing couples should understand these 4 tax issues

- ByPolk & Associates

- Oct, 30, 2020

- All News & Information

- Comments Off on Divorcing couples should understand these 4 tax issues

When a couple is going through a divorce, taxes are probably not foremost on their minds. But without proper planning, some people find divorce to be even more taxing. Several concerns should be addressed to ensure that taxes are kept to a minimum. For example, if you sell your principal residence or one spouse remains living there while the other moves out, you want to make sure you’ll be able to avoid tax on up to $500,000 of gain. You also must decide how to file your return for the year (single, married filing jointly, married filing separately or head of household). There are other issues you may have to deal with. We can help you work through them.

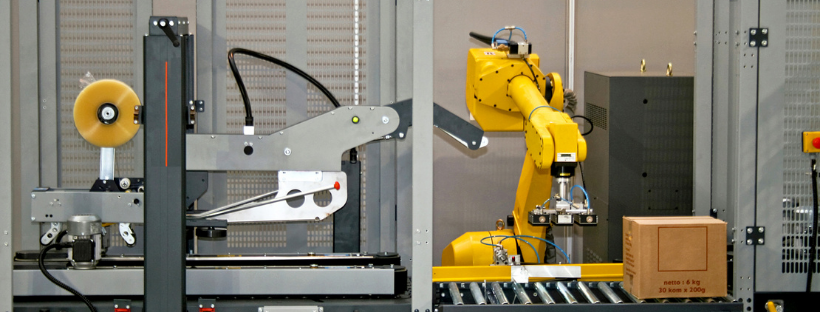

How robotic technology will disrupt the manufacturing industry

- ByPolk & Associates

- Oct, 26, 2020

- All News & Information, Manufacturing

- Comments Off on How robotic technology will disrupt the manufacturing industry

Robotics technology has the potential to disrupt industries across all sectors – but its impact on the manufacturing industry will be transformative. Not only can robots increase productivity, efficiency and profit margins but adopting this tech for good will be a key way for the manufacturing industry to transition to a more sustainable future.

You must be logged in to post a comment.