Unusual Delivery Service Mailing Scam

- ByPolk & Associates

- Jul, 11, 2023

- Uncategorized

- Comments Off on Unusual Delivery Service Mailing Scam

The IRS and the Security Summit warned taxpayers to be on the lookout for a new scam mailing that tries to mislead people into believing they are owed a refund. The new scheme involves a mailing which comes in a cardboard envelope from a delivery service. The enclosed letter includes the IRS masthead and wording […]

Are you married and not earning compensation? You may be able to put money in an IRA

- ByPolk & Associates

- Jun, 28, 2023

- All News & Information

- Comments Off on Are you married and not earning compensation? You may be able to put money in an IRA

If one spouse in a married couple doesn’t earn compensation, the couple may not be able to save as much as they need for retirement. An IRA contribution is generally only allowed if you earn compensation. But an exception exists. A spousal IRA allows a contribution for a spouse who doesn’t earn compensation. For 2023, an eligible couple can contribute $6,500 to an IRA for each spouse ($7,500 if the spouse will be 50 by the end of the year). However, if the working spouse is an active participant in an employer retirement plan, a deductible contribution can be made to the nonparticipant spouse’s IRA only if the couple’s adjusted gross income doesn’t exceed a certain threshold.

The Trust Fund Recovery Penalty: Who can it be personally assessed against?

- ByPolk & Associates

- Jun, 28, 2023

- All News & Information

- Comments Off on The Trust Fund Recovery Penalty: Who can it be personally assessed against?

If you own or manage a business, there’s a harsh tax penalty that you could be at risk for paying personally. The Trust Fund Recovery Penalty (TFRP) applies to any willful failure to collect and pay over Social Security and income taxes required to be withheld from employees’ wages. Taxes are considered government property and employers hold them in “trust” until they’re paid over to the IRS. The penalty is also sometimes called the “100% penalty” because the people found liable and responsible for the taxes will be penalized 100% of the taxes due. The IRS is aggressive in enforcing the TFRP and the amounts are usually substantial so never “borrow” from withheld taxes. Questions? Contact us.

Cultivate connections with a well-used CRM system

- ByPolk & Associates

- Jun, 28, 2023

- All News & Information

- Comments Off on Cultivate connections with a well-used CRM system

Customer relationship management (CRM) software enables businesses to gather, track, manage and analyze customer-related data in a multitude of ways. It’s designed to give staff access to comprehensive information about individuals and businesses with an established connection to your company as well as those of interest to you. But one of the potential risks of buying CRM software is that it may wind up being underused. To get an adequate return on investment, it’s essential to get everyone’s buy-in. Also provide plenty of training, both when implementing new software and when maintaining an existing system. Contact us for help measuring and managing your company’s technology costs.

The best way to survive an IRS audit is to prepare

- ByPolk & Associates

- Jun, 28, 2023

- All News & Information

- Comments Off on The best way to survive an IRS audit is to prepare

The IRS recently released audit statistics for fiscal year 2022 and few taxpayers had their returns examined. Overall, just 0.49% of individual returns were audited. Historically, this is very low. However, even though a small percentage of returns are being audited these days, that will be little consolation if yours is one of them. Plus, the Biden administration has made it a priority to go after high-income taxpayers who don’t pay what they owe. The best way to survive an IRS audit is to prepare. On an ongoing basis, maintain documentation (invoices, bills, canceled checks, receipts, etc.) for items reported on your returns. Contact us if you receive an IRS audit letter.

When can seniors deduct Medicare premiums on their tax returns?

- ByPolk & Associates

- Jun, 28, 2023

- All News & Information

- Comments Off on When can seniors deduct Medicare premiums on their tax returns?

If you’re age 65 and older and have basic Medicare insurance, you may need to pay additional premiums to get the level of coverage you want. The premiums can be costly, especially for married couples with both spouses paying them. But there may be an advantage: You may qualify for a tax break for paying the premiums. However, it can be difficult to qualify to claim medical expenses on your tax return. For 2023, you can deduct medical expenses only if you itemize deductions and only to the extent that total qualifying expenses exceeded 7.5% of adjusted gross income. We can determine whether you should claim the standard deduction or claim medical expense deductions on your tax return.

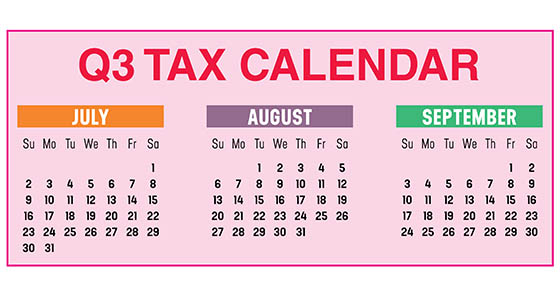

2023 Q3 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Jun, 28, 2023

- All News & Information

- Comments Off on 2023 Q3 tax calendar: Key deadlines for businesses and other employers

Here are a few key tax-related deadlines for businesses and other employers during the third quarter of 2023. JULY 31: Report income tax withholding and FICA taxes for Quarter 2 of 2023 (unless eligible for an Aug. 10 deadline). File a 2022 calendar-year retirement plan report or request an extension. SEPT. 15: If you operate a calendar-year partnership or S corp. that filed an extension, file a 2022 income tax return and pay any tax, interest and penalties due. SEPT. 15: If a calendar-year C corp., pay third installment of 2023 estimated income taxes. Contact us for more about the filing requirements and to ensure you meet all applicable deadlines.

Hiring family members can offer tax advantages (but be careful)

- ByPolk & Associates

- Jun, 28, 2023

- All News & Information

- Comments Off on Hiring family members can offer tax advantages (but be careful)

Are you thinking about hiring your child or spouse to work at your business this summer? There may be some tax advantages to doing so. For example, for a sole proprietorship or partnership in which each partner is a parent of the child-employee, children under age 18 aren’t subject to FICA or FUTA taxes. And children who are 18 to 20 are subject to FICA taxes but not FUTA taxes. If your spouse goes to work for your business, his or her wages are subject to income tax withholding and FICA taxes but not FUTA taxes. However, in either case, you’ll need to treat your child or spouse just as you would any other employee. Our firm can help you handle the situation properly.

In financial planning, forecasts and projections aren’t the same

- ByPolk & Associates

- Jun, 28, 2023

- All News & Information

- Comments Off on In financial planning, forecasts and projections aren’t the same

Financial statements are historical records that depict a company’s financial position as of a certain point in time. To estimate where your business may end up in the future, you need to create either a forecast or a projection. What’s the difference? A forecast presents expected results based on an expected course of action. Alternatively, a projection estimates expected results based on one or more hypothetical situations. Bear in mind that few forecasts or projections are completely accurate. But one or the other can be of great help in financial planning. Contact us for assistance generating properly prepared financial statements as well as useful forecasts and projections.

Advantages and disadvantages of claiming big first-year real estate depreciation deductions

- ByPolk & Associates

- Jun, 12, 2023

- All News & Information

- Comments Off on Advantages and disadvantages of claiming big first-year real estate depreciation deductions

Section 179 allows businesses to deduct (rather than depreciate over several years) the costs of eligible assets, such as equipment and furniture. The deduction can also be claimed for real estate qualified improvement property (QIP). For eligible assets placed in service in 2023, the maximum allowable first-year Sec. 179 deduction is $1.16 million. QIP includes improvements to an interior portion of a nonresidential building that are placed in service after the building is placed in service. QIP also includes HVAC systems, nonresidential roofs and alarm systems that are placed in service after the building is first placed in service. Consult with us about how to proceed.

You must be logged in to post a comment.