Facing a future emergency? Two new tax provisions may soon provide relief

- ByPolk & Associates

- Nov, 01, 2023

- All News & Information

- Comments Off on Facing a future emergency? Two new tax provisions may soon provide relief

Perhaps you’ve been in this situation: You’re facing an emergency and need some cash. You consider taking money out of a traditional IRA or 401(k) account but if you’re under age 59½, distributions are taxable and generally subject to a 10% penalty. Good news: Beginning in 2024, there will be relief for some employees facing emergencies. The SECURE 2.0 law contains a provision that allows employers with 401(k)s and 403(b)s to offer pension-linked emergency savings accounts to non-highly compensated employees. Contributions will be limited to up to $2,500 a year and will be included in taxable income, but participants won’t have to pay tax when making withdrawals. Other rules apply.

The Social Security wage base for employees and self-employed people is increasing in 2024

- ByPolk & Associates

- Nov, 01, 2023

- All News & Information

- Comments Off on The Social Security wage base for employees and self-employed people is increasing in 2024

In a recent announcement, the Social Security Administration revealed that the wage base for computing Social Security tax will increase to $168,600 for 2024 (up from $160,200 for 2023). Wages and self-employment income above this threshold aren’t subject to Social Security tax. The Federal Insurance Contributions Act imposes two taxes on employers, employees and self-employed workers. One is for Social Security tax, and the other is for Medicare tax. There’s a maximum amount of compensation subject to the Social Security tax, but no maximum for Medicare tax. For 2024, the FICA tax rate for employers will be 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2023).

Valuations can help business owners plan for the future

- ByPolk & Associates

- Oct, 18, 2023

- All News & Information

- Comments Off on Valuations can help business owners plan for the future

As a business owner, you might think the only purpose of a valuation is to prepare your company for sale. But an appraisal can serve other purposes as well. For example, if you need a capital infusion to fulfill a strategic objective, a valuation can help you present timely, in-depth financial data to lenders. The process may also enable you to recognize operational weaknesses, so you can devise ways to strengthen these shortcomings. Perhaps you do need to prepare for a transfer of business interests of some variety, such as an acquisition, sale or gift. If so, an appraiser can help you plan for the transaction’s optimal timing, pricing and tax impact. Contact us for more information.

How IRS auditors learn about your business industry

- ByPolk & Associates

- Oct, 18, 2023

- All News & Information

- Comments Off on How IRS auditors learn about your business industry

Ever wonder how IRS auditors know about different industries so they can audit businesses? They generally do research about specific industries and issues on tax returns by using IRS Audit Techniques Guides (ATGs). These guides are available on the IRS website. So businesses can use them to gain insight into what the IRS is looking for in terms of compliance. Many ATGs target specific industries, such as architecture, art galleries, retail and veterinary medicine. Others address issues that frequently arise in audits, such as executive comp and passive activity losses. The IRS has revised or added new guides in recent years. For a complete list of ATGs: https://bit.ly/2rh7umD

Are scholarships tax-free or taxable?

- ByPolk & Associates

- Oct, 18, 2023

- All News & Information

- Comments Off on Are scholarships tax-free or taxable?

With the rising cost of college, many families are in search of scholarships. If your child receives one, you may wonder how it affects your taxes. Good news: Scholarships are generally tax-free for students in elementary, middle and high schools, as well as those attending college, graduate school or an accredited vocational school. It doesn’t matter if the scholarship makes a direct payment to the individual or reduces tuition. However, certain conditions must be met. A scholarship is tax-free if it’s used to pay for tuition and fees required to attend the school, and fees, books, supplies and equipment required of students. Room and board, travel, research and clerical help don’t qualify.

Business automobiles: How the tax depreciation rules work

- ByPolk & Associates

- Oct, 18, 2023

- All News & Information

- Comments Off on Business automobiles: How the tax depreciation rules work

If you use an automobile in your business, you may wonder how depreciation tax deductions are determined. The rules are complicated, and special limits that apply to vehicles classified as passenger autos can make it take longer than expected to fully depreciate a vehicle. First, note that if you use the “standard mileage rate” (65.5 cents per business mile driven for 2023), a depreciation allowance is built into the rate and you don’t need to worry about the depreciation calculations. But if you choose to use the “actual expense method” to claim deductions on a passenger auto, depreciation is calculated each year based on the car’s cost, how much you use it for business and other factors.

A refresher on the trust fund recovery penalty for business owners and executives

- ByPolk & Associates

- Oct, 18, 2023

- All News & Information

- Comments Off on A refresher on the trust fund recovery penalty for business owners and executives

The trust fund recovery penalty has nothing to do with estate planning. Rather, the IRS uses it to hold accountable “responsible persons” who willfully withhold income and payroll taxes from employees’ wages and fail to remit those taxes to the federal government. The penalty is 100% of unpaid taxes, though it applies to only employees’ share of the taxes in question. The IRS may name anyone within or outside a business who possesses significant control or influence over the company’s finances as a responsible person. If several responsible persons are identified, each may be held liable for the full amount of the penalty. Contact us for more information and help staying in compliance.

The tax implications of renting out a vacation home

- ByPolk & Associates

- Oct, 18, 2023

- All News & Information

- Comments Off on The tax implications of renting out a vacation home

Many people own a vacation home in a waterfront community, the mountains or elsewhere. If you do, you may want to rent it out part of the year. The tax implications can be complex. It depends on how many days it’s rented and your personal use. Personal use includes vacation use by you, certain relatives and nonrelatives if market rent isn’t charged. But, if you rent the property for less than 15 days during a year, it’s not treated as “rental property.” This can produce revenue and tax breaks. Any rent you receive isn’t included in your income for tax purposes. However, you can only deduct property taxes and mortgage interest (no other operating costs or depreciation). We can help you plan.

What are the tax implications of winning money or valuable prizes?

- ByPolk & Associates

- Oct, 04, 2023

- All News & Information

- Comments Off on What are the tax implications of winning money or valuable prizes?

If you gamble or buy lottery tickets and you’re lucky enough to win, congratulations! But be aware there are tax consequences. You must report 100% of your winnings as taxable income. If you itemize deductions, you can deduct losses but only up to the amount of winnings. You report lottery winnings as income in the year they’re actually received. In the case of noncash prizes (such as a car), this would also be the year the prize is received. With cash, if you take the winnings in annual installments, you only report each year’s installment as income for that year. These are the basic rules. Contact us with questions. We can help you stay in compliance with all the tax requirements.

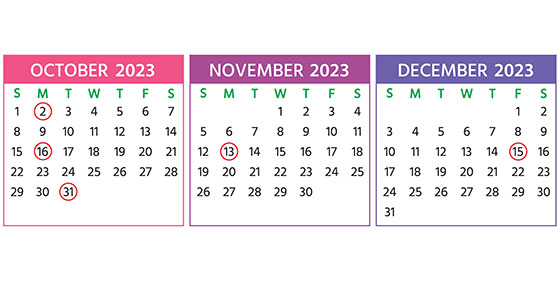

2023 Q4 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Oct, 04, 2023

- All News & Information

- Comments Off on 2023 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some important fourth quarter 2023 tax-filing dates for businesses. OCT. 16: If you’re the owner or operator of a calendar-year C corp. which filed an extension, file a 2022 income tax return. OCT. 31: Report income tax withholding and FICA taxes for Q3 2023 (unless you’re eligible for a Nov. 13 deadline because you deposited on time and in full all of the associated taxes due). DEC. 15: If a calendar-year C corp., pay the fourth installment of 2023 estimated income taxes. Note: Certain deadlines may be postponed in federally declared disaster areas. We can provide more information about filing requirements and ensure you’re meeting all applicable deadlines.