3 types of internal benchmarking reports for businesses

- ByPolk & Associates

- Jan, 09, 2024

- All News & Information

- Comments Off on 3 types of internal benchmarking reports for businesses

Business owners, within your company’s financial statements lies a treasure trove of insights that can help you spot trends, both positive and negative. Here are three types of internal benchmarking reports that can help you make these discoveries: 1) Horizontal analysis, which is a comparison of two or more sets of financial statements with differences expressed in dollar amounts or percentages. 2) Vertical analysis, whereby each line item of a single set of financial statements is converted to a percentage of another item (often revenue or total assets). 3) Ratio analysis, which depicts relationships between various items on a company’s financial statements. Contact us for more info.

Don’t overlook taxes when contemplating a move to another state

- ByPolk & Associates

- Jan, 09, 2024

- All News & Information

- Comments Off on Don’t overlook taxes when contemplating a move to another state

When you retire, you may want to move to another state, perhaps because the weather is more temperate or because you want to be closer to family members. Don’t forget to factor state and local taxes into the equation. It may seem like a state with no income tax is a wise choice, but you should also consider property and sales taxes, as well as any state estate taxes. If you move to a new state and want to escape taxes in the state you came from, it’s important to establish legal domicile in the new location. Take steps such as changing your mailing address, and registering to vote and getting a driver’s license in the new state. We can answer any questions and file required tax returns.

The standard business mileage rate will be going up slightly in 2024

- ByPolk & Associates

- Jan, 09, 2024

- All News & Information

- Comments Off on The standard business mileage rate will be going up slightly in 2024

The optional standard mileage rate used to calculate the deductible cost of operating a vehicle for business will be going up slightly in 2024, by 1.5 cents per mile. The IRS recently announced that the cents-per-mile rate for the business use of a car, van, pickup or panel truck will be 67 cents. The increased tax deduction partly reflects the price of gas. On Dec. 21, the national average price of a gallon of regular gas was $3.12, compared with $3.10 a year earlier, according to AAA Gas Prices. The standard rate is useful if you don’t want to keep track of actual vehicle-related expenses. But you still must record certain information, such as the mileage, dates and destinations of trips.

POLK & ASSOCIATES EXPANDS REACH AND STRENGTHENS TEAM WITH STRATEGIC MERGER

- ByPolk & Associates

- Jan, 08, 2024

- All News & Information

- Comments Off on POLK & ASSOCIATES EXPANDS REACH AND STRENGTHENS TEAM WITH STRATEGIC MERGER

New merger bolster expertise, experience and industry-specific knowledge in key core competencies Bingham Farms, MI – November 1, 2023 – Polk & Associates (POLK) announces a strategic merger with Apartment Data Corporation that bolsters core and expands practices such as Valuation Services, Audit and Assurance, Business Acquisition, CAS, Estate and Succession Planning and Tax Planning […]

Business Taxes – Michigan Flow-through Entity (FTE) Elective Tax

- ByPolk & Associates

- Jan, 08, 2024

- All News & Information

- Comments Off on Business Taxes – Michigan Flow-through Entity (FTE) Elective Tax

Re-Election FTE Reminder or FTE First-Time Election If the first year that your business elected the Michigan Flow-Through Entity (FTE) Tax was 2021, and your business would like to remain in the Michigan FTE program, then you will want to read this article. If you have not elected the Michigan Flow-Through Entity Tax in the […]

Reinvigorating your company’s sales efforts heading into the new year

- ByPolk & Associates

- Dec, 20, 2023

- All News & Information

- Comments Off on Reinvigorating your company’s sales efforts heading into the new year

Business owners, as we head into the new year, look for ways to reinvigorate your company’s sales efforts. For example, given the “new normal” of less business travel, you may be able to revise your sales territory plan so it’s less focused on travel and more aimed at aligning salespeople with regions that contain their most winnable prospects. Also, outdated or overly complicated software can slow sales momentum. Gather feedback on whether you should upgrade or change your systems. Last, identify optimal ways to incentivize your sales staff. This might include boosted commissions or bonuses based on increased sales to current customers or number of prospects converted. Contact us for help.

Court awards and out-of-court settlements may (or may not) be taxed

- ByPolk & Associates

- Dec, 20, 2023

- All News & Information

- Comments Off on Court awards and out-of-court settlements may (or may not) be taxed

Monetary awards and settlements are paid for many reasons. For example, a person could receive payments for personal injury or discrimination. By law, individuals can exclude from gross income damages that are received on account of personal physical injury or physical sickness. For purposes of this exclusion, emotional distress isn’t considered physical injury or sickness. So an award under state law that’s meant to compensate for emotional distress caused by age discrimination would have to be included in gross income. However, if you require medical care for treating the consequences of emotional distress, the amount of damages not exceeding those expenses would generally be excludable.

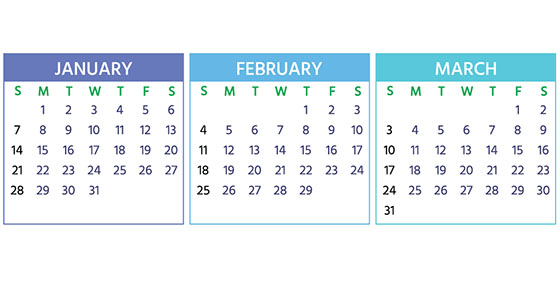

2024 Q1 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Dec, 20, 2023

- All News & Information

- Comments Off on 2024 Q1 tax calendar: Key deadlines for businesses and other employers

Here are a few key tax-related deadlines for businesses during the first quarter of 2024. JAN. 16: Pay the final installment of 2023 estimated tax. JAN. 31: File 2023 Forms W-2 with the Social Security Administration and provide copies to employees. Also provide copies of 2023 Forms 1099-NEC to recipients and file them with the IRS. FEB. 28: File 2023 Forms 1099-MISC if paper filing. (Otherwise, the filing deadline is April 1.) MARCH 5: If a calendar-year partnership or S corp., file or extend your 2023 tax return. Contact us to learn more about filing requirements and ensure you’re meeting all applicable deadlines.

How businesses can get better at data capture

- ByPolk & Associates

- Dec, 13, 2023

- All News & Information

- Comments Off on How businesses can get better at data capture

Almost every kind of business today is data-driven. For this very reason, “data capture” has become a critical yet often overlooked capability of most companies. Simply put, data capture is the process of extracting information from a physical source and converting it into a digital format. Of course, it doesn’t work the same way for every company. That’s why you should identify your mission-critical data and where it comes from. Also train and equip your employees to optimally capture data. Naturally, you must also secure your data so hackers and unauthorized users can’t corrupt, steal or kidnap it in a ransomware attack. Contact us for help managing your company’s technology costs.

The “nanny tax” must be paid for nannies and other household workers

- ByPolk & Associates

- Dec, 13, 2023

- All News & Information

- Comments Off on The “nanny tax” must be paid for nannies and other household workers

You may have heard of the “nanny tax.” But if you don’t employ a nanny, you may think it doesn’t apply to you. Check again. Hiring a housekeeper or other household employee (who isn’t an independent contractor) may make you liable for federal income tax, Social Security and Medicare (FICA) tax and unemployment tax. You may also have state tax obligations. In 2023, you must withhold and pay FICA taxes if your worker earns cash wages of $2,600 or more. This will increase to $2,700 in 2024. You pay household worker obligations by increasing quarterly estimated tax payments or increasing withholding from wages (not by paying a lump sum). Employment taxes are then reported on your tax return.

You must be logged in to post a comment.