Hospital Deals Accelerate in 2018

- ByPolk & Associates

- Jun, 04, 2018

- All News & Information, Health Care

- Comments Off on Hospital Deals Accelerate in 2018

Hospital mergers and acquisitions accelerated during the first part of 2018, according to deal-tracking companies. Hospitals were involved in 25 transactions in the first quarter of 2018, which would translate to the highest annual rate since 2015, according to Irving Levin Associates.

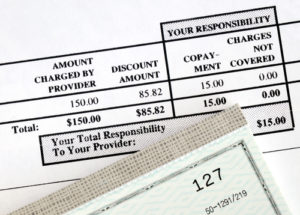

Show me the money: transparency builds trust

- ByPolk & Associates

- Jun, 04, 2018

- All News & Information, Health Care

- Comments Off on Show me the money: transparency builds trust

Many providers still don’t offer the price transparency that 91 percent of healthcare consumers seek. Yet offering cost information upfront does not change most patients’ buying behaviors. Nearly half say they require the information for budget planning purposes. Only 11 percent use such information to shop around for a different provider.

New incentives for hospitals are improving quality of care for patients at home

- ByPolk & Associates

- Jun, 04, 2018

- All News & Information, Health Care

- Comments Off on New incentives for hospitals are improving quality of care for patients at home

A recent report from The Commonwealth Fund found the percentage of home-health patients who got better at walking or moving around, a key measure of quality of care, rose in every state from 2013 to 2016. The group, which tracks performance in health systems nationwide, also found that hospital readmission rates for elderly Medicare beneficiaries continued to fall in nearly half the states from 2012 to 2015.

Saving tax on restricted stock awards with the Sec. 83(b) election

- ByPolk & Associates

- May, 30, 2018

- All News & Information

- Comments Off on Saving tax on restricted stock awards with the Sec. 83(b) election

If you receive restricted stock from your employer, you may have a tax-saving opportunity: the Section 83(b) election. Income recognition for restricted stock normally is deferred until the stock is vested or you sell it, when you pay taxes on the fair market value at your ordinary-income rate. But if you make the Sec. 83(b) election, you recognize ordinary income when you receive the stock. This converts future appreciation from ordinary income to long-term capital gains income taxed at lower rates. We can help determine whether the election makes sense for you.

Putting your child on your business’s payroll for the summer may make more tax sense than ever

- ByPolk & Associates

- May, 30, 2018

- All News & Information

- Comments Off on Putting your child on your business’s payroll for the summer may make more tax sense than ever

For business owners with kids in high school or college, hiring them for the summer can provide many benefits. One is tax savings. By shifting business income to a child as wages for services performed, you can turn high-taxed income into tax-free or low-taxed income. The Tax Cuts and Jobs Act’s near doubling of the standard deduction means your child can shelter more income from taxes. Changes to the “kiddie tax” make income shifting via earned income rather than unearned income even more appealing. Many rules apply; contact us to learn more.

US Factory Production Rose a Healthy 0.5 Percent in April

- ByRick Williams

- May, 30, 2018

- All News & Information, Manufacturing

- Comments Off on US Factory Production Rose a Healthy 0.5 Percent in April

U.S. factories cranked out more appliances, computers and aircraft last month, lifting manufacturing production for only the second time in five months.

Could Looming Supply Chain Risks Sink Your Company?

- ByRick Williams

- May, 30, 2018

- All News & Information, Manufacturing

- Comments Off on Could Looming Supply Chain Risks Sink Your Company?

Supply chains are suddenly under threat. Following years of low inflation and stable trade relations, executive teams in boardrooms across the globe are now grappling with rising inflation, a rapidly changing trade environment and the dire threat of an all-out trade war. Already, pressure is up sharply on earnings, and many leaders fear that traditional cost-saving measures may no longer be enough to avoid a heavy hit.

3 Trends Driving Modern Manufacturing Innovation

- ByRick Williams

- May, 30, 2018

- All News & Information, Manufacturing

- Comments Off on 3 Trends Driving Modern Manufacturing Innovation

Industry 4.0 is the integration of manufacturing automation and data exchange, to create what has been dubbed as a “smart factory.” These factories will be controlled by a virtual production line that runs systems and monitors and completes their physical processes. These systems will communicate in real time, whether that means a customer tracking the progress of his (or her) order’s production, or a company ensuring the quality of its operations. Simply put, connected software systems will run our physical manufacturing automatically.

Workforce succession in manufacturing

- ByRick Williams

- May, 30, 2018

- All News & Information, Manufacturing

- Comments Off on Workforce succession in manufacturing

UI Labs earlier this year released The Digital Workforce Succession in Manufacturing, a report that “strives to capture a sense of the changing technology and business interactions, and job roles that are having an impact on our manufacturing sector. This modernization and advancement of technology effects the entire ecosystem of manufacturers (from the small to the huge), educators, government, and the workforce itself.”

Sending your kids to day camp may provide a tax break

- ByPolk & Associates

- May, 25, 2018

- All News & Information

- No Comments

When school lets out, kids participate in a wide variety of summer activities. If one of the activities your child is involved with is day camp, you might be eligible for a tax break! Day (not overnight) camp is a qualified expense under the child and dependent care credit, which generally is worth 20% of qualifying expenses, up to $3,000 for one qualifying child and $6,000 for two or more. Eligible costs for care must be work-related, and additional rules apply. Contact us for help determining your eligibility for this credit and other tax breaks for parents.