How to avoid getting hit with payroll tax penalties

- ByPolk & Associates

- Jul, 12, 2018

- All News & Information

- Comments Off on How to avoid getting hit with payroll tax penalties

For small businesses, managing payroll can be one of the most arduous tasks. A crucial aspect is withholding and remitting to the federal government the appropriate income and employment taxes. If your business doesn’t, you, personally, as the business’s owner, could be considered a “responsible party” and face a 100% penalty. This is true even if your business is an entity that normally shields owners from personal liability, such as a corporation or limited liability company. Hiring a payroll service can help. Contact us to learn more.

Is your inventory getting the better of you?

- ByPolk & Associates

- Jul, 12, 2018

- All News & Information

- Comments Off on Is your inventory getting the better of you?

Has your inventory been getting the better of you? Don’t give up on showing it who’s boss. If inaccurate inventory counts are the problem, consider cycle counting. This involves taking weekly or monthly physical counts of warehoused inventory and comparing them to levels tracked electronically. Speaking of which, having the right technology is key. It may be time to upgrade or even replace your inventory software. You can also use tech to better determine what your customers want via online surveys and social media. Let us help you get control of your inventory.

Home green home: Save tax by saving energy

- ByPolk & Associates

- Jul, 12, 2018

- All News & Information

- Comments Off on Home green home: Save tax by saving energy

“Going green” at home can reduce your tax bill in addition to your energy bill, all while helping the environment. To reap all three benefits, you need to buy and install certain types of renewable energy equipment in your home. For 2018, you may be eligible for a tax credit of 30% of expenditures for installing qualified solar electricity generating equipment, solar water heating equipment, wind energy equipment, geothermal heat pump equipment and fuel cell electricity generating equipment. Additional rules and limits apply. To learn more, contact us.

Does your business have to begin collecting sales tax on all out-of-state online sales?

- ByPolk & Associates

- Jul, 12, 2018

- All News & Information

- Comments Off on Does your business have to begin collecting sales tax on all out-of-state online sales?

The recent U.S. Supreme Court decision in South Dakota v. Wayfair allows states to impose sales tax on more out-of-state online sales. But does it mean your business must immediately begin collecting sales tax on online sales to all out-of-state customers? No. You must collect such taxes only if the particular state requires it. South Dakota’s law, for example, requires out-of-state retailers that made at least 200 sales or sales totaling at least $100,000 in the state to collect sales tax. But laws vary dramatically from state to state. Contact us with questions.

3 keys to a successful accounting system upgrade

- ByPolk & Associates

- Jul, 12, 2018

- All News & Information

- Comments Off on 3 keys to a successful accounting system upgrade

Today’s accounting software can perform adequately for years, but improved features are being created all the time. Here are three key considerations to help you decide when to upgrade: 1) Your users’ tech savvy needs to align with the system’s level of sophistication. 2) Costs matter: Set a firm budget and focus on only needed functions. Also look into add-ons such as free trials, initial training and ongoing support. 3) If you haven’t already integrated your accounting software with other systems, doing so is advisable. We can provide further guidance.

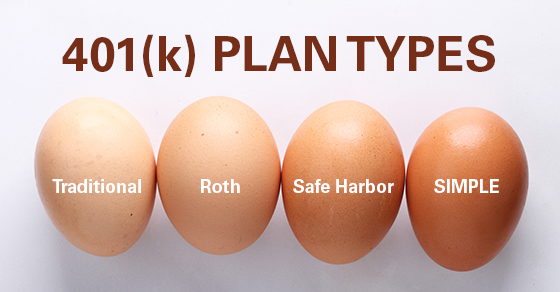

Finding a 401(k) that’s right for your business

- ByPolk & Associates

- Jun, 27, 2018

- All News & Information

- Comments Off on Finding a 401(k) that’s right for your business

Ready to offer a 401(k) plan? Know your options: Traditional 401(k)s let employees contribute pretax dollars and give employers the option of matching contributions. But rigorous testing rules apply. Roth 401(k)s allow employees to contribute after-tax dollars and take tax-free withdrawals (subject to limitations). Safe harbor 401(k)s avoid strict testing but require certain employer contributions. Smaller businesses may offer SIMPLE 401(k)s, which are akin to safe harbor plans but have lower required employer contributions and employee contribution limits.

Do you know the ABCs of HSAs, FSAs and HRAs?

- ByPolk & Associates

- Jun, 27, 2018

- All News & Information

- Comments Off on Do you know the ABCs of HSAs, FSAs and HRAs?

Do you know the ABCs of HSAs, FSAs and HRAs? The accounts in this “alphabet soup” offer tax-advantaged health care funding. If you have a qualified high-deductible health plan (HDHP), you can contribute to an HSA. It can grow tax-deferred similar to an IRA. An HDHP isn’t required for you to contribute to an FSA. What you don’t use by year end, you lose, but there are exceptions. An HRA also doesn’t require an HDHP, but only your employer can contribute. Any unused portion typically is carried forward. Questions about taxes and health care expenses? Contact us.

Choosing the best business entity structure post-TCJA

- ByPolk & Associates

- Jun, 27, 2018

- All News & Information

- Comments Off on Choosing the best business entity structure post-TCJA

On the surface, the TCJA’s new, flat 21% income tax rate for C corporations may make choosing C corp structure for your business seem like a no-brainer. After all, 21% is much lower than the 37% top rate that applies to pass-through entities (such as partnerships and S corps). But C corps can still be subject to double taxation. And pass-through entity owners may be eligible for the TCJA’s new 20% qualified business income deduction. The best entity type for your business depends on its unique situation and your situation as an owner. Contact us to learn more.

Investors Have Options in a Trade War

- ByRick Williams

- Jun, 27, 2018

- All News & Information, Manufacturing

- Comments Off on Investors Have Options in a Trade War

While some opportunities result, the market doesn’t embrace uncertainty.

How to Be Smart about Shaking Things Up

- ByRick Williams

- Jun, 27, 2018

- All News & Information, Manufacturing

- Comments Off on How to Be Smart about Shaking Things Up

Does your organization need change, but you don’t know where to start? Here are some principles for heading down the turbulent path.