Could conversational marketing speak to your business?

- ByPolk & Associates

- Jun, 12, 2024

- All News & Information

- Comments Off on Could conversational marketing speak to your business?

Businesses have long been advised to engage in active dialogues with customers and prospects. But historically, this tended to take a long time. There’s now a much faster way to conduct these interactions called “conversational marketing.” The basic concept is to strike up real-time discussions with customers and prospects as soon as they contact you. You’re not looking to give them sales pitches; you want to first create authentic social connections. Conversational marketing generally occurs on tech-based channels such as company websites (using chatbots or live chat with human reps), social media, and text and email. For help determining whether it’s right for your business, contact us.

House rich but cash poor? Consider a reverse mortgage strategy

- ByPolk & Associates

- Jun, 12, 2024

- All News & Information

- Comments Off on House rich but cash poor? Consider a reverse mortgage strategy

Are you a taxpayer age 62 or older who needs income and owns a house that has appreciated greatly? A reverse mortgage may be a solution. With one, you can raise needed cash and also take advantage of the tax-saving basis “step-up” rule. The federal tax basis of a capital gain asset owned by a person who dies, including a personal residence, is stepped up to fair market value as of the date of the owner’s death. If your home’s value stays about the same between your date of death and the date your heirs sell it, there will be little or no taxable gain because the sale proceeds will be nearly or fully offset by the stepped-up basis.

Inflation enhances the 2025 amounts for Health Savings Accounts

- ByPolk & Associates

- Jun, 12, 2024

- All News & Information

- Comments Off on Inflation enhances the 2025 amounts for Health Savings Accounts

The IRS recently released the inflation-adjusted amounts for Health Savings Accounts (HSAs) next year. For 2025, the annual contribution limit for an individual with self-only coverage under an HDHP will be $4,300. For an individual with family coverage, the amount will be $8,550. These are up from $4,150 and $8,300, respectively, for 2024. For calendar year 2025, an HDHP will be a health plan with an annual deductible that isn’t less than $1,650 for self-only coverage or $3,300 for family coverage. And annual out-of-pocket expenses (deductibles, co-payments and other amounts, but not premiums) won’t be able to exceed $8,300 for self-only coverage or $16,600 for family coverage.

Timelines: 3 ways business owners should look at succession planning

- ByPolk & Associates

- Jun, 12, 2024

- All News & Information

- Comments Off on Timelines: 3 ways business owners should look at succession planning

Business owners are urged to develop succession plans so their companies will pass on to the next generation, or another iteration of ownership, in an optimal manner. But, as many learned during the pandemic, life comes at you fast. That’s why succession planning should best be viewed from three parallel timelines: 1) Long term; focus on identifying and mentoring a successor, as well as strategizing how to fund your retirement and structure your estate plan. 2) Short term; if retirement or another opportunity becomes imminent, look more at selling the company or even liquidating. 3) In case of emergency; be prepared for a crisis that may incapacitate you. Contact us for assistance.

Should you convert your business from a C to an S corporation?

- ByPolk & Associates

- Jun, 12, 2024

- All News & Information

- Comments Off on Should you convert your business from a C to an S corporation?

The most common business structures are sole proprietorships, partnerships, LLCs, C corporations and S corporations. Choosing the right entity has many implications, including the taxes you pay. Although S corps may provide tax advantages over C corps in some cases, there are potential tax problems to assess before converting from C to S status. One issue to consider is last-in, first-out (LIFO) inventory. A C corp that uses LIFO must pay tax on the benefits it derived by using LIFO if it converts to an S corp. Other issues are the built-in gains tax, passive income tax and unused net operating losses. If you’re interested in an entity change, contact us to learn about the implications.

You may be entitled to tax breaks if caring for an elderly relative

- ByPolk & Associates

- Jun, 12, 2024

- All News & Information

- Comments Off on You may be entitled to tax breaks if caring for an elderly relative

There are many personal rewards for taking care of an elderly relative. You could also be eligible for tax breaks. For example, if the person qualifies as your dependent and you itemize deductions on your return, you can include any medical expenses you incur for him or her along with your own when determining your medical deduction. If you aren’t married, you may qualify for head-of-household status, which has a higher standard deduction and lower tax rates than a single filer. You may also qualify for the Credit for Other Dependents (nonchild) or the dependent care credit for costs you incur for the individual’s care to enable you and your spouse to go to work. Contact us with questions.

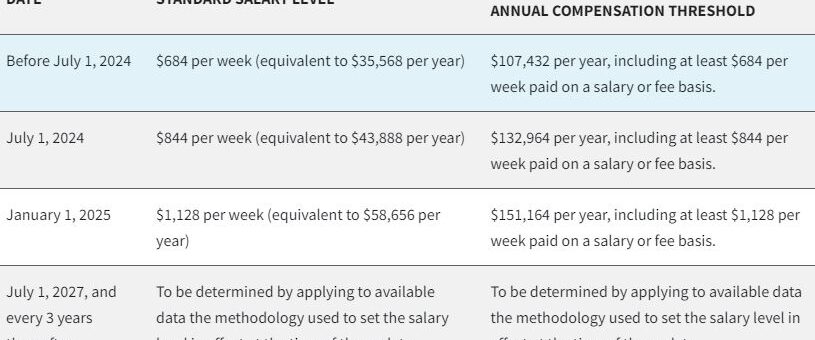

Final Rule: Restoring and Extending Overtime Protections

- ByPolk & Associates

- May, 24, 2024

- All News & Information

- Comments Off on Final Rule: Restoring and Extending Overtime Protections

Originally Posted on the U.S. Department of Labor Website NOTICE: On April 23, 2024, the U.S. Department of Labor (Department) announced a final rule, Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees, which will take effect on July 1, 2024. The final rule updates and revises the regulations issued under […]

A three-step strategy to save tax when selling appreciated vacant land

- ByPolk & Associates

- May, 22, 2024

- All News & Information

- Comments Off on A three-step strategy to save tax when selling appreciated vacant land

Let’s say you own one or more vacant lots. The property has appreciated greatly and you’re ready to sell. Or maybe you have a parcel of appreciated land that you want to subdivide into lots, develop them and sell them off for a big profit. Either way, you’ll incur a tax bill. There’s a strategy to consider that allows favorable long-term capital gain tax treatment (rather than ordinary income treatment) for all the pre-development appreciation in the value of your land. 1) Establish an S corporation. 2) Sell the land to the S corp. 3) Have the S corp develop the land and sell it off. Several rules and limits apply, so this isn’t a DIY project. Contact us for assistance and to avoid pitfalls.

Tax tips when buying the assets of a business

- ByPolk & Associates

- May, 22, 2024

- All News & Information

- Comments Off on Tax tips when buying the assets of a business

If you’re buying a business, you want the best results possible AFTER taxes. You can potentially structure a purchase in two ways: 1) Buy the business assets. 2) Buy the seller’s entity ownership interest. If you’re buying assets, you must allocate the purchase price to the specific assets acquired. The amount allocated to each asset becomes the initial tax basis of that asset. For depreciable and amortizable assets (such as furniture, equipment, buildings, software and intangibles such as customer lists), the initial tax basis determines the post-acquisition tax deductions. The allocation process can lead to better or worse post-acquisition tax results. Contact us for assistance.

Businesses must face the reality of cyberattacks and continue fighting back

- ByPolk & Associates

- May, 22, 2024

- All News & Information

- Comments Off on Businesses must face the reality of cyberattacks and continue fighting back

Many experts are now urging business owners to view cyberattacks as more of a certainty than a possibility. Why? Because they seem to be happening to just about every company in one way or another. What can your small-to-midsize business do to protect itself? First and foremost, you need a comprehensive cybersecurity strategy that accounts for not only your technology, but also your people, processes and as many known external threats as possible. The good news is there are free resources available online, such as policy templates and program frameworks. However, you may need to invest in an IT consultant for customized assistance. For help managing your technology costs, contact us.

You must be logged in to post a comment.