Cost transformation is imperative, but hospital efforts are lagging behind, survey shows

- ByPolk & Associates

- Oct, 25, 2018

- Health Care

- Comments Off on Cost transformation is imperative, but hospital efforts are lagging behind, survey shows

Close to 60 percent of responding executives say their organizations have processes and structures in place to achieve cost transformation goals.

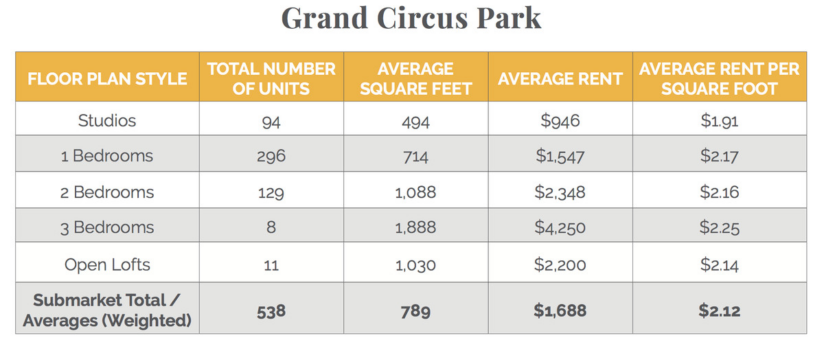

Latest Detroit rent report shows increasing prices, high occupancy rates downtown

- ByPolk & Associates

- Oct, 25, 2018

- Real Estate

- Comments Off on Latest Detroit rent report shows increasing prices, high occupancy rates downtown

New apartments are commanding over $3 per square foot

Six Fundamentals Of Supply And Demand That Multifamily Investors Shouldn’t Miss

- ByPolk & Associates

- Oct, 25, 2018

- Real Estate

- Comments Off on Six Fundamentals Of Supply And Demand That Multifamily Investors Shouldn’t Miss

In an ever-changing world, it can be hard to keep the fundamentals of real estate investing in focus as new research and information are made available at a lightning pace.

How Tech is Impacting Key Consideration Factors for Renters

- ByPolk & Associates

- Oct, 25, 2018

- Real Estate

- Comments Off on How Tech is Impacting Key Consideration Factors for Renters

While industry technology has advanced at a breakneck pace, the main concerns and priorities for prospective renters have stayed the same over time. Here is a look at the top four.

Reduce insurance costs by encouraging employee wellness

- ByPolk & Associates

- Oct, 25, 2018

- All News & Information

- Comments Off on Reduce insurance costs by encouraging employee wellness

The safer your workplace, the less likely you’ll incur high workers’ compensation premiums. But think about the impact of employee wellness on other insurance costs, too. From a physical well-being standpoint, a formal wellness program can encourage healthier life choices and thereby reduce health coverage costs. In terms of mental health, providing the right training and offering an employee assistance program can create a more positive work environment and lessen the likelihood of accidents and lawsuits that drive up insurance costs. Contact us for more info.

Could “bunching” medical expenses into 2018 save you tax?

- ByPolk & Associates

- Oct, 25, 2018

- All News & Information

- Comments Off on Could “bunching” medical expenses into 2018 save you tax?

Some of your medical expenses may be tax deductible, but only if you itemize deductions and have enough expenses to exceed the applicable floor for deductibility. With proper planning, you may be able to time controllable medical expenses to your tax advantage. The Tax Cuts and Jobs Act (TCJA) could make bunching such expenses into 2018 beneficial for some taxpayers. At the same time, certain taxpayers who’ve benefited from the deduction in previous years might no longer benefit because of the TCJA’s increase to the standard deduction. Contact us to learn more.

Selling your business? Defer — and possibly reduce — tax with an installment sale

- ByPolk & Associates

- Oct, 25, 2018

- All News & Information

- Comments Off on Selling your business? Defer — and possibly reduce — tax with an installment sale

You’re ready to sell your business and want to get the return from it you’ve earned from the time and money you’ve invested. That means getting a good price and minimizing the tax hit on the proceeds. One option that can help defer tax is an installment sale. Spreading gain over several years is especially beneficial if it allows you to stay under the thresholds for triggering the 3.8% net investment income tax or the 20% long-term capital gains rate. But it’s not without tax risk. For help determining whether an installment sale is right for you, contact us.

Following the ABCs of customer assessment

- ByPolk & Associates

- Oct, 17, 2018

- All News & Information

- Comments Off on Following the ABCs of customer assessment

Every established business should regularly assess its customer base. One way to approach this task is to follow the ABCs. First, choose a time period and use financial data to calculate your customers’ profitability. Next, divide customers into three groups: 1) an A group of your most profitable buyers, 2) a B group of positive contributors, and 3) a C group of unprofitable customers. From here you can focus on nurturing relationships with the A group, elevating the status of B-group customers, and possibly moving on from the C group. Contact us for help.

Consider all the tax consequences before making gifts to loved ones

- ByPolk & Associates

- Oct, 17, 2018

- All News & Information

- Comments Off on Consider all the tax consequences before making gifts to loved ones

Many people choose to pass assets to the next generation during life, whether to reduce the size of their taxable estate, to help out family members or simply to see their loved ones enjoy the gifts. If you’re considering lifetime gifts, be aware that which assets you give can affect the tax consequences. For example, to minimize your heir’s income tax, gift property that hasn’t appreciated significantly while you’ve owned it. The heir can sell the property at a minimal income tax cost. Contact us to discuss the tax consequences of any gifts you’d like to make.

Now’s the time to review your business expenses

- ByPolk & Associates

- Oct, 17, 2018

- All News & Information

- Comments Off on Now’s the time to review your business expenses

As we approach the end of the year, it’s a good idea to review your business’s expenses for deductibility. At the same time, consider whether you’d benefit from accelerating certain expenses into this year. There’s no master list of deductible business expenses in the Internal Revenue Code (IRC). Some deductions are expressly authorized or excluded, but most are governed by the general rule of IRC Sec. 162, which permits businesses to deduct their “ordinary and necessary” expenses. Also, the TCJA reduces or eliminates many deductions. Contact us to learn more.