The possible tax landscape for businesses in the future

- ByPolk & Associates

- Aug, 15, 2024

- All News & Information

- Comments Off on The possible tax landscape for businesses in the future

The upcoming elections may significantly alter the tax landscape of U.S. businesses. The reason has to do with provisions of the Tax Cuts and Jobs Act (TCJA) that are set to expire on Dec. 31, 2025. One significant change is the scheduled expiration of the qualified business income (QBI) deduction. This write-off is for up to 20% of QBI from noncorporate entities. What will happen to your taxes depends on different possible outcomes: For example, all expiring TCJA provisions could expire. Or some provisions could expire and others could be extended or made permanent. New laws could also be enacted to provide different tax breaks and/or rates. We’ll keep you informed so stay tuned.

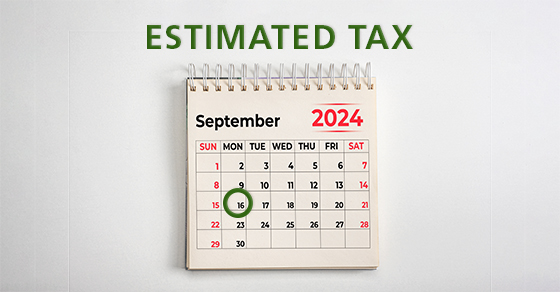

Do you owe estimated taxes? If so, when is the next one due?

- ByPolk & Associates

- Aug, 15, 2024

- All News & Information

- Comments Off on Do you owe estimated taxes? If so, when is the next one due?

Federal estimated tax payments ensure that certain individuals pay their taxes throughout the year. You may have to make estimated payments if you receive interest, dividends, self-employment income, capital gains, a pension or other income. If you don’t pay enough during the year through withholding and estimated payments, you may be liable for a penalty on top of the tax due. Individuals must generally pay 25% of their required annual tax four times annually with Form 1040-ES. The next payment is due Sept. 16 (because the usual Sept. 15 due date falls on a Sunday). You may be able to use the annualized income method to make smaller payments if your income isn’t uniform over the year.

Businesses should stay grounded when using cloud computing

- ByPolk & Associates

- Aug, 15, 2024

- All News & Information

- Comments Off on Businesses should stay grounded when using cloud computing

For a couple decades now, companies have been urged to “get on the cloud” to avail themselves of data storage and software via the internet. But one recent report found that many businesses were overpaying for cloud services because they were failing to claim discounts offered by their providers. The truth is, cloud computing arrangements and invoices tend to be complicated. Be sure you and your leadership team know what you’re getting into with a cloud contract, familiarize yourselves with the content of invoices, identify and claim discounts you’re entitled to, and closely monitor cloud usage. Our firm can help you assess the costs and potential savings of cloud computing.

Vroom vroom: What businesses should know about sales velocity

- ByPolk & Associates

- Jul, 17, 2024

- All News & Information

- Comments Off on Vroom vroom: What businesses should know about sales velocity

Owning and running a company tends to test one’s patience. You wait for strategies to play out. You wait for materials, supplies or equipment to arrive. You wait for key positions to be filled. But, when it comes to sales, how patient should you be? A widely used metric called “sales velocity” can help you decide. […]

If your business has co-owners, you probably need a buy-sell agreement

- ByPolk & Associates

- Jul, 17, 2024

- All News & Information

- Comments Off on If your business has co-owners, you probably need a buy-sell agreement

Are you buying a business that will have one or more co-owners? Or do you already own one fitting that description? If so, consider installing a buy-sell agreement. A well-drafted agreement can: 1) transform your business ownership interest into a more liquid asset, 2) prevent unwanted ownership changes, and 3) avoid estate tax hassles with the IRS. The death of a co-owner is an event that triggers a buy-sell agreement. You can use life insurance policies to form the financial backbone of your agreement. In the simplest case of a cross-purchase agreement between two co-owners, each co-owner purchases a life insurance policy on the other. Contact us about setting up a buy-sell agreement.

3 Areas of focus for companies looking to control costs

- ByPolk & Associates

- Jul, 17, 2024

- All News & Information

- Comments Off on 3 Areas of focus for companies looking to control costs

Controlling costs is a fundamental task for every business. But where and how to address this challenge can change over time based on various factors. One recent survey revealed three top categories for cost-cutting initiatives: 1) Supply chain; identify your top vendors and see whether you can consolidate spending with them to put yourself in a stronger position to negotiate volume discounts. 2) Labor; be sure you know precisely how much you’re truly spending. A metric called labor burden rate can help. Outsourcing and tech upgrades may help, too. 3) Marketing and sales; choosing and monitoring the right metrics is essential for controlling these costs as well. Contact us for help.

Planning your estate? Don’t overlook income taxes

- ByPolk & Associates

- Jul, 17, 2024

- All News & Information

- Comments Off on Planning your estate? Don’t overlook income taxes

The high federal estate tax exemption ($13.61 million in 2024) means that many people aren’t concerned with estate tax. But you should still consider saving income tax for your heirs. For example, be careful making lifetime transfers of appreciated assets. It’s true that the assets and future appreciation generated by them are removed from your estate. But a gift carries a potential income tax cost because the recipient receives your basis upon transfer. He or she could face capital gains tax on the future sale of the gifted property. If the appreciated property is held until your death, under current law, the heir will get a “step-up” in basis that will reduce or wipe out capital gains tax.

Be aware of the tax consequences of selling business property

- ByPolk & Associates

- Jul, 17, 2024

- All News & Information

- Comments Off on Be aware of the tax consequences of selling business property

If you’re selling property used in your trade or business, you should understand the tax implications. Many rules may apply. Let’s assume you want to sell land or depreciable property used in your business and held for more than a year. Gains and losses from sales of business property are netted against each other. The net gain or loss qualifies for tax treatment as follows: 1) If the netting of gains and losses results in a net gain, long-term capital gain treatment results, subject to “recapture” rules. Long-term capital gain is generally more favorable than ordinary income. 2) If the netting of gains and losses results in a net loss, the loss is fully deductible against ordinary income.

Could a 412(e)(3) retirement plan suit your business?

- ByPolk & Associates

- Jul, 17, 2024

- All News & Information

- Comments Off on Could a 412(e)(3) retirement plan suit your business?

When companies are ready to sponsor a qualified retirement plan, they have many options. One under-the-radar choice is a 412(e)(3) plan. Unlike 401(k) plans, these are defined benefit plans funded with insurance and annuity contracts. Older business owners who want to maximize retirement savings in a short time may want to check out 412(e)(3)s. Why? Because, assuming they have few if any highly compensated employees, owners can take a large share of the financial benefits while also enjoying tax deductions for plan contributions. As is the case with defined benefit plans, however, sponsors must have the financial stability to support the plan indefinitely. Contact us for more information.

Certain charitable donations allow you to avoid taxable IRA withdrawals

- ByPolk & Associates

- Jul, 17, 2024

- All News & Information

- Comments Off on Certain charitable donations allow you to avoid taxable IRA withdrawals

Are you philanthropic? If you’re 70½ or older, you may want to consider making a cash donation from your IRA to an eligible charity. This potential tax-saving strategy is called a qualified charitable distribution (QCD). How does it save tax? When required minimum distributions (RMDs) are taken out of traditional IRAs, federal income tax (and possibly state tax) must be paid. But not if you transfer IRA assets to charity via a QCD. In 2024, you can direct up to $105,000 of RMDs to charity. The money given to charity counts toward your RMDs but doesn’t increase your adjusted gross income (AGI), which may allow you to qualify for other tax breaks. Questions? Contact us.

You must be logged in to post a comment.