Using your 401(k) plan to save this year and next

- ByPolk & Associates

- Nov, 14, 2019

- All News & Information

- Comments Off on Using your 401(k) plan to save this year and next

Does your employer offer a 401(k) or Roth 401(k) plan? Contributing to it is a taxwise way to build a nest egg. If you’re not already socking away the maximum allowed, consider increasing your contribution between now and year end. With a 401(k), an employee elects to have a certain amount of pay deferred and contributed by an employer on his or her behalf to the plan. The contribution limit for 2019 is $19,000. Employees age 50 or older by year end are also permitted to make additional “catch-up” contributions of $6,000, for a total limit of $25,000 in 2019. The IRS just announced that the 401(k) contribution limit for 2020 will increase to $19,500 (plus the $6,000 catch-up contribution).

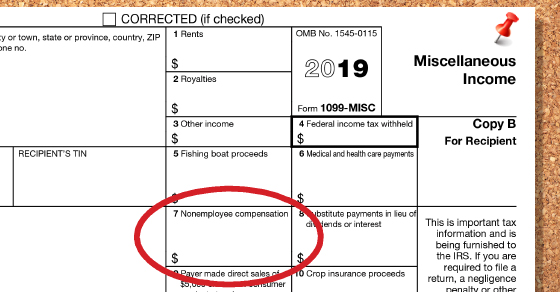

Small businesses: Get ready for your 1099-MISC reporting requirements

- ByPolk & Associates

- Nov, 14, 2019

- All News & Information

- Comments Off on Small businesses: Get ready for your 1099-MISC reporting requirements

Early next year, your business may be required to comply with Form 1099 rules. You may have to send forms to independent contractors, vendors and others whom you pay nonemployee compensation, as well as file them with the IRS. There are penalties for noncompliance. Employers must provide a Form 1099-MISC for nonemployee compensation by Jan. 31, 2020, to each noncorporate service provider who was paid at least $600 for services during 2019. (1099-MISCs generally don’t have to be provided to corporate service providers.) A copy of each Form 1099-MISC with payments listed in box 7 must also be filed with the IRS by Jan. 31. If you have questions about your reporting requirements, contact us.

Reducing wasteful spending in healthcare by curbing administrative complexity

- ByPolk & Associates

- Nov, 13, 2019

- Health Care

- Comments Off on Reducing wasteful spending in healthcare by curbing administrative complexity

Wasteful spending is an increasingly thorny problem in healthcare, especially with the industry comprising an ever-larger portion of GDP.

The TeleDentists Offers Dental Second Opinions

- ByPolk & Associates

- Nov, 13, 2019

- Health Care

- Comments Off on The TeleDentists Offers Dental Second Opinions

The TeleDentists delivers vital dental services virtually wherever, whenever a dentist is needed. A proprietary, national network of Licensed dentists use secure online video consults to connect with patients’ smart phones, laptops or tablets. They diagnose problems, start remediation and, when needed, arrange next business day appointments with a conveniently located dentist. The service is available to hospitals, urgent care facilities, retail clinics, self-insured corporations, senior-living centers, universities and telemedicine service providers. Visit https://www.theteledentists.com

Insurance, subscriptions, and apps: The changing landscape of patient payment options

- ByPolk & Associates

- Nov, 13, 2019

- Health Care

- Comments Off on Insurance, subscriptions, and apps: The changing landscape of patient payment options

As dental practices struggle to keep afloat with insurance payments alone, new options such as membership plans and Chewsi are becoming more common. Ann-Marie DePalma provides this guide for dental hygienists on today’s payment options.

Can anything be built in Detroit without subsidies?

- ByPolk & Associates

- Nov, 13, 2019

- Real Estate

- Comments Off on Can anything be built in Detroit without subsidies?

Why every new development in the city comes with incentives

Real Estate Investors to Benefit from the Federal Reserve’s Third Interest-Rate Cut

- ByPolk & Associates

- Nov, 13, 2019

- Real Estate

- Comments Off on Real Estate Investors to Benefit from the Federal Reserve’s Third Interest-Rate Cut

The central bank lowered the benchmark interest rate a quarter of a percentage point to a range of 1.5% to 1.75%.

Preparing for the Nation’s Senior Wave

- ByPolk & Associates

- Nov, 13, 2019

- Real Estate

- Comments Off on Preparing for the Nation’s Senior Wave

Developers seek solutions for aging adults who will have a huge variety needs for housing and services—and a wide range of income levels.

How to Invest in Multifamily Housing

- ByPolk & Associates

- Nov, 13, 2019

- Real Estate

- Comments Off on How to Invest in Multifamily Housing

Apartment rentals can trump single-family rentals for investors.

IRS Announces 401(k) Contribution Limit Increases for 2020

- ByPolk & Associates

- Nov, 13, 2019

- All News & Information

- Comments Off on IRS Announces 401(k) Contribution Limit Increases for 2020

The Internal Revenue Service today announced that employees in 401(k) plans will be able to contribute up to $19,500 next year. The IRS announced this and other changes in Notice 2019-59 (PDF), posted today on IRS.gov. This guidance provides cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2020. Highlights […]