Michigan Sales Tax: Change in Taxability of Delivery & Installation Charges

- ByPolk & Associates

- May, 11, 2023

- Uncategorized

- Comments Off on Michigan Sales Tax: Change in Taxability of Delivery & Installation Charges

If you are doing business in Michigan and either charging to your customers/patients/clients Michigan Sales Tax or paying Use Tax for purchases in the State of Michigan, this article explains a change that the State of Michigan Treasury views the taxability of delivery and installation charges. Effective April 26, 2023 delivery and installation charges are […]

Beware of Scammers

- ByPolk & Associates

- Apr, 03, 2023

- Uncategorized

- Comments Off on Beware of Scammers

The IRS urges taxpayers and tax professionals to remain vigilant in the face of emails and text scams aimed at tricking people about refunds or tax issues in the second of the 2023 Dirty Dozen tax scams. These messages arrive in the form of unsolicited texts or emails which try to lure unsuspecting victims into […]

Is now the time for your small business to launch a retirement plan?

- ByPolk & Associates

- Jan, 25, 2023

- Uncategorized

- Comments Off on Is now the time for your small business to launch a retirement plan?

Is it time for your small business to offer a retirement plan? The federal government is offering incentives for you to do so. The SECURE 2.0 Act, recently signed into law, enhances the small employer pension plan start-up cost tax credit. SECURE 2.0 makes the credit equal to the full amount of creditable plan start-up costs for employers with 50 or fewer employees, up to an annual cap. The previous 50% cost limit still applies to employers with 51 to 100 employees. Also, certain employer contributions for a plan’s first five years now may qualify for the credit, and the act fixes a technical glitch related to multiemployer plans. Contact us for more info.

Commercial Clean Vehicle Credit

- ByPolk & Associates

- Jan, 24, 2023

- Uncategorized

- Comments Off on Commercial Clean Vehicle Credit

For Businesses and tax-exempt organizations looking to purchase new commercial clean vehicles in 2023, you may qualify for the New Commercial Clean Vehicle Credit The credit is offered to Businesses and Tax-exempt organizations There is no limit to the number of credits used by the business The credit is non-refundable The credit can be carried […]

Reinforce your cybersecurity defenses regularly

- ByPolk & Associates

- Nov, 10, 2022

- Uncategorized

- Comments Off on Reinforce your cybersecurity defenses regularly

Unlike the lock to a physical door, which generally protects property for a long time, a business’s cybersecurity measures need to be regularly updated and reinforced. Most cyberattacks fall into two categories: ransomware and social engineering. In a ransomware attack, hackers infiltrate a company’s computer network, encrypt or freeze critical data, and hold that data hostage until their ransom demands are met. Meanwhile, social engineering attacks use manipulation and pressure to trick employees into giving up sensitive data or granting cyberthieves access to internal systems and bank accounts. Be sure to keep your cybersecurity policies, training methods and security measures up to date.

Qualifying Pass Through Entities Tax

- ByPolk & Associates

- Jul, 06, 2022

- Uncategorized

- Comments Off on Qualifying Pass Through Entities Tax

On June 14, 2022, the Ohio governor signed into law a workaround for the $10,000 SALT deduction limitation imposed by the Tax Cut and Jobs Act of 2017. Qualifying Pass Through Entities (PTE), including S corporations and partnerships, may elect to pay Ohio income taxes at the entity level beginning in 2022. The election is […]

IRS continues work to help taxpayers; suspends mailing of additional letters

- ByPolk & Associates

- Feb, 15, 2022

- Uncategorized

- Comments Off on IRS continues work to help taxpayers; suspends mailing of additional letters

Source: IRS Website As part of ongoing efforts to provide additional help for people during this period, the IRS announced today the suspension of more than a dozen additional letters, including the mailing of automated collection notices normally issued when a taxpayer owes additional tax, and the IRS has no record of a taxpayer filing […]

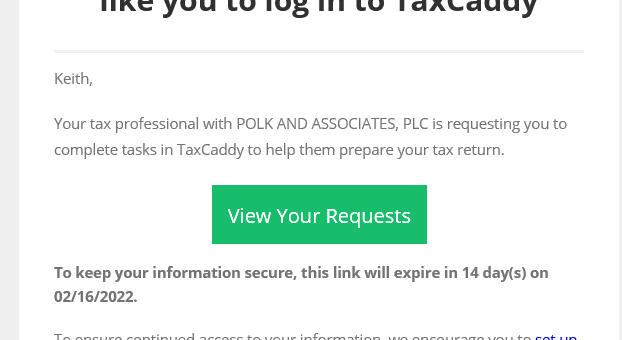

Polk & Associates TaxCaddy Software Update

- ByPolk & Associates

- Feb, 04, 2022

- Uncategorized

- Comments Off on Polk & Associates TaxCaddy Software Update

Polk and Associates, PLC is excited to announce the utilization of TaxCaddy software to assist in the preparation of your individual tax return. If you have been utilizing our ShareFile software, expect a TaxCaddy invitation in the coming days. TaxCaddy simplifies tax time by allowing you to: Easily gather documents year-round by Uploading them from […]

You must be logged in to post a comment.