The tax implications if your business engages in environmental cleanup

- ByPolk & Associates

- Nov, 22, 2019

- All News & Information

- Comments Off on The tax implications if your business engages in environmental cleanup

If your company needs to “remediate” or clean up environmental contamination, the expenses involved can be tax deductible. Unfortunately, every type of environmental cleanup expense cannot be currently deducted. Some cleanup costs must be capitalized. For example, remediation costs generally have to be capitalized if the remediation adds significantly to the value of the cleaned-up property; prolongs the useful life of the property; or adapts it to a new or different use. In addition to federal tax deductions, there may be state or local tax incentives involved in cleaning up contaminated property. If you have environmental cleanup expenses, we can help maximize the deductions available.

3 key traits of every successful salesperson

- ByPolk & Associates

- Nov, 14, 2019

- All News & Information

- Comments Off on 3 key traits of every successful salesperson

Every business needs to set performance management standards for its sales department. These standards help drive productivity and, thereby, profitability. Focus on the three key traits of successful salespeople. First, there’s aptitude. Not everyone is cut out for sales. An employee who’s a bad fit could be moved to another department or simply let go. The second trait is effective tactics. Although there are many ways to sell, a good salesperson builds lasting and fruitful relationships with customers. The third trait is strong numbers. Identify and track sales metrics that are fair to your staff and reflect the strategic goals of the business. We can help you crunch the numbers.

Using your 401(k) plan to save this year and next

- ByPolk & Associates

- Nov, 14, 2019

- All News & Information

- Comments Off on Using your 401(k) plan to save this year and next

Does your employer offer a 401(k) or Roth 401(k) plan? Contributing to it is a taxwise way to build a nest egg. If you’re not already socking away the maximum allowed, consider increasing your contribution between now and year end. With a 401(k), an employee elects to have a certain amount of pay deferred and contributed by an employer on his or her behalf to the plan. The contribution limit for 2019 is $19,000. Employees age 50 or older by year end are also permitted to make additional “catch-up” contributions of $6,000, for a total limit of $25,000 in 2019. The IRS just announced that the 401(k) contribution limit for 2020 will increase to $19,500 (plus the $6,000 catch-up contribution).

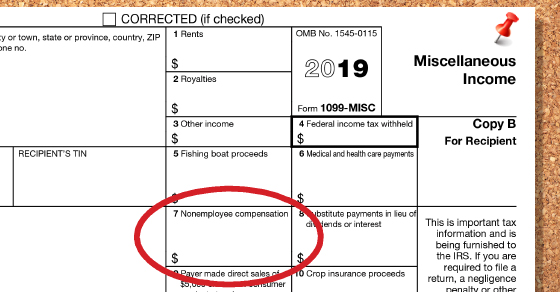

Small businesses: Get ready for your 1099-MISC reporting requirements

- ByPolk & Associates

- Nov, 14, 2019

- All News & Information

- Comments Off on Small businesses: Get ready for your 1099-MISC reporting requirements

Early next year, your business may be required to comply with Form 1099 rules. You may have to send forms to independent contractors, vendors and others whom you pay nonemployee compensation, as well as file them with the IRS. There are penalties for noncompliance. Employers must provide a Form 1099-MISC for nonemployee compensation by Jan. 31, 2020, to each noncorporate service provider who was paid at least $600 for services during 2019. (1099-MISCs generally don’t have to be provided to corporate service providers.) A copy of each Form 1099-MISC with payments listed in box 7 must also be filed with the IRS by Jan. 31. If you have questions about your reporting requirements, contact us.

IRS Announces 401(k) Contribution Limit Increases for 2020

- ByPolk & Associates

- Nov, 13, 2019

- All News & Information

- Comments Off on IRS Announces 401(k) Contribution Limit Increases for 2020

The Internal Revenue Service today announced that employees in 401(k) plans will be able to contribute up to $19,500 next year. The IRS announced this and other changes in Notice 2019-59 (PDF), posted today on IRS.gov. This guidance provides cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2020. Highlights […]

Is multicloud computing right for your business?

- ByPolk & Associates

- Nov, 08, 2019

- All News & Information

- Comments Off on Is multicloud computing right for your business?

Cloud computing is now commonplace, but new derivatives continue to emerge. Under the “multicloud” approach, companies distribute data and computing needs among several providers. Doing so can maximize scalability (increasing or decreasing functionality as needed), improve performance and open a wider menu of options. But there are risks. Some businesses unintentionally engage in multicloud computing when different departments start using public clouds on their own, threatening security. Managing multiple clouds can also be complex and leveraging each provider’s features can be difficult. Finally, you must consider the total cost of ownership. Contact us for help.

You may be ABLE to save for a disabled family member with a tax-advantaged account

- ByPolk & Associates

- Nov, 08, 2019

- All News & Information

- Comments Off on You may be ABLE to save for a disabled family member with a tax-advantaged account

There’s a tax-advantaged way for people to save for the needs of family members with disabilities, without having them lose eligibility for government benefits to which they’re entitled. It’s done though an ABLE account, which is a tax-free account that can be used for disability-related expenses. ABLE accounts can be created by eligible individuals to support themselves, by family members to support their dependents, or by guardians. Contributions up to the annual gift-tax exclusion amount, currently $15,000, can be made to an account each year. If the beneficiary works, he or she can also contribute some income to their ABLE account. Contact us if you’d like more details.

Small businesses: Stay clear of a severe payroll tax penalty

- ByPolk & Associates

- Nov, 08, 2019

- All News & Information

- Comments Off on Small businesses: Stay clear of a severe payroll tax penalty

Managing payroll is a laborious task for small businesses. But it’s critical to withhold the right amount of taxes from employees and pay them over to the federal government on time. If you don’t, you could be hit with the Trust Fund Recovery Penalty, also known as the 100% penalty. It applies to the Social Security and income taxes required to be withheld by a business from its employees’ wages. It’s called the 100% penalty because people liable or responsible for the taxes can be personally penalized 100% of the taxes due. Absolutely no failure to withhold and no “borrowing” from withheld amounts should ever be allowed in your business. Contact us for more information.

A shadow board could shed light on your company’s best future

- ByPolk & Associates

- Nov, 01, 2019

- All News & Information

- Comments Off on A shadow board could shed light on your company’s best future

Many businesses are still run by older boards of directors (and management teams) that, while rich in experience, might not stay closely attuned to the latest demographic-driven developments pertinent to the company. For this reason, some businesses are establishing “shadow” boards composed of younger, nonexecutive employees who are on the front lines of changing tastes and lifestyles. A shadow board can learn from the actual board or management team while keeping senior leadership abreast of the latest trends, concerns and tech. It can also weigh in on potential changes to employee benefits and help the business retain those who serve on the board. Contact us for more info.

IRA charitable donations are an alternative to taxable required distributions

- ByPolk & Associates

- Nov, 01, 2019

- All News & Information

- Comments Off on IRA charitable donations are an alternative to taxable required distributions

Are you charitably minded and have a significant amount of money in an IRA? If you’re age 70-1/2 or older, and don’t need the money from required minimum distributions, you may benefit by giving these amounts to charity. A popular way to transfer IRA assets to charity is through a tax provision that allows IRA owners who are 70-1/2 or older to give up to $100,000 per year of their IRA distributions to charity. These distributions are called qualified charitable distributions, or QCDs. The money given to charity counts toward the donor’s required minimum distributions (RMDs) but doesn’t increase the donor’s adjusted gross income or generate a tax bill. Contact us for more information.