Should you go phishing with your employees?

- ByPolk & Associates

- Nov, 13, 2020

- All News & Information

- Comments Off on Should you go phishing with your employees?

As a business owner, you’re probably aware of the danger of “phishing.” This is when a fraudster sends a phony communication (usually an email) that appears to be from a reputable source but is really an attempt to get recipients to reveal sensitive information or expose their computers to malware. Ever considered trying it yourself? Many companies are intentionally sending fake emails to employees to determine how many will fall for the scams. But it’s hardly a risk-free strategy. You’ll need to budget for the costs of buying, installing and maintaining phishing simulation software. And you’ll have to consider the ethical implications of deceiving your employees. Contact us for more info.

Disability income: How is it taxed?

- ByPolk & Associates

- Nov, 13, 2020

- All News & Information

- Comments Off on Disability income: How is it taxed?

You may wonder if and how disability income is taxed. It depends on who paid for the benefit. If the income is paid directly to you by an employer, it’s taxable to you as ordinary salary would be. (Taxable benefits are also subject to federal tax withholding, although they may not be subject to Social Security tax.) Sometimes, payments aren’t made by an employer but by an insurance company under a policy providing disability coverage or other insurance. In this case, the tax treatment depends on who paid for the coverage. If an employer paid, the income is taxed to you just as if paid directly to you by the employer. But if it’s a policy you paid for, the payments you receive aren’t taxable.

Tax responsibilities if your business is closing amid the pandemic

- ByPolk & Associates

- Nov, 13, 2020

- All News & Information

- Comments Off on Tax responsibilities if your business is closing amid the pandemic

Unfortunately, COVID-19 has forced many businesses to shut down. If this is your situation, we’re here to assist you in any way we can, including taking care of various tax obligations. A business must file a final income tax return and some other related forms for the year it closes. If you have employees, you must pay them final wages and compensation owed, make final federal tax deposits and report employment taxes. Failure to withhold or deposit employee income, Social Security and Medicare taxes can result in personal liability for what’s known as the Trust Fund Recovery Penalty. There may be other responsibilities. Contact us to discuss these issues and to get answers to any questions.

Now more than ever, carefully track payroll records

- ByPolk & Associates

- Oct, 30, 2020

- All News & Information

- Comments Off on Now more than ever, carefully track payroll records

Payroll recordkeeping was important in the “old normal,” but it’s even more important now as businesses continue to navigate their way through a slowly recovering economy and continuing COVID-19 pandemic. Under the “records-in-general” rule, most employers must keep information relating to federal income, Social Security and Medicare taxes for at least four years after the due date of an employee’s personal income tax return (generally, April 15) for the year in which the payment was made. A variety of data and documents fall under the rule, including employees’ personal identification data (such as Social Security numbers) and their compensation amounts. Contact us for more information.

Divorcing couples should understand these 4 tax issues

- ByPolk & Associates

- Oct, 30, 2020

- All News & Information

- Comments Off on Divorcing couples should understand these 4 tax issues

When a couple is going through a divorce, taxes are probably not foremost on their minds. But without proper planning, some people find divorce to be even more taxing. Several concerns should be addressed to ensure that taxes are kept to a minimum. For example, if you sell your principal residence or one spouse remains living there while the other moves out, you want to make sure you’ll be able to avoid tax on up to $500,000 of gain. You also must decide how to file your return for the year (single, married filing jointly, married filing separately or head of household). There are other issues you may have to deal with. We can help you work through them.

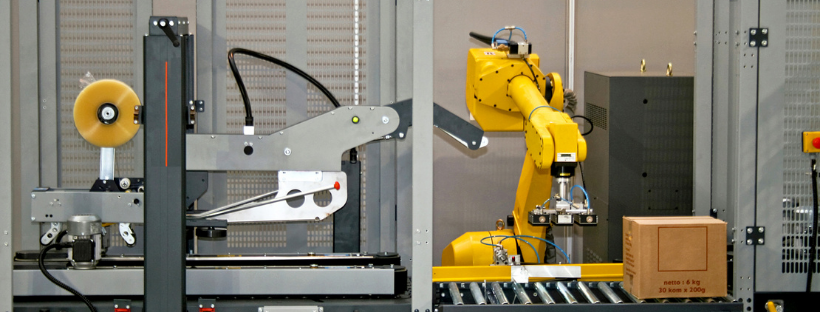

How robotic technology will disrupt the manufacturing industry

- ByPolk & Associates

- Oct, 26, 2020

- All News & Information, Manufacturing

- Comments Off on How robotic technology will disrupt the manufacturing industry

Robotics technology has the potential to disrupt industries across all sectors – but its impact on the manufacturing industry will be transformative. Not only can robots increase productivity, efficiency and profit margins but adopting this tech for good will be a key way for the manufacturing industry to transition to a more sustainable future.

5 questions about real estate for manufacturing

- ByPolk & Associates

- Oct, 26, 2020

- All News & Information, Manufacturing

- Comments Off on 5 questions about real estate for manufacturing

When it comes to making post-COVID-19 decisions about real estate, manufacturers are in a tricky position.

Inventory management is especially important this year

- ByPolk & Associates

- Oct, 26, 2020

- All News & Information

- Comments Off on Inventory management is especially important this year

This year, most companies’ financial statements will reflect the impact of the COVID-19 pandemic on sales and expenses. Be sure to look at inventory management as well. Carrying too much inventory can reflect poorly on a business as the value of surplus items drops throughout the year. Refine your inventory processes and trim excess items. If yours is a more service-oriented business, apply a similar approach. Check into whether you’re “overstocking” on services that aren’t contributing to profitability. Be prepared to make tough decisions about customers to whom you provide services that aren’t profitable anymore. Contact us for help.

New business? It’s a good time to start a retirement plan

- ByPolk & Associates

- Oct, 26, 2020

- All News & Information

- Comments Off on New business? It’s a good time to start a retirement plan

If you recently launched a business, you may want to set up a tax-favored retirement plan for yourself and your employees. There are several types of qualified plans that are eligible for these tax advantages: A current deduction from income to the employer for plan contributions, tax-free buildup of the value of plan investments, and the deferral of income (augmented by investment earnings) to employees until funds are distributed. The two basic types of plans are defined benefit pensions and defined contribution plans, such as 401(k) plans. There are also SEPs and SIMPLEs, which are easy to set up and maintain. Contact us to discuss the types of retirement plans available to you.

Buying and selling mutual fund shares: Avoid these tax pitfalls

- ByPolk & Associates

- Oct, 26, 2020

- All News & Information

- Comments Off on Buying and selling mutual fund shares: Avoid these tax pitfalls

If you invest in mutual funds, there are potential pitfalls involved in buying and selling shares. For example, you may already have made taxable “sales” of part of your mutual fund without knowing it. One way this can happen is if your mutual fund allows you to write checks against your fund investment. If you write a check against your mutual fund account, you’ve made a partial sale of your interest in the fund (except for funds such as money market funds, for which share value remains constant). Thus, you may have taxable gain (or a deductible loss) when you write a check. And each such sale is a separate transaction that must be reported on your tax return. Contact us with questions.