Building customers’ trust in your website

- ByPolk & Associates

- Feb, 18, 2021

- All News & Information

- Comments Off on Building customers’ trust in your website

The COVID-19 pandemic has likely accelerated the growth of e-commerce by years. As a result, building customers’ trust in your website is more important than ever. First, ensure visitors can tell that you’re a bona fide business staffed by actual human beings. Include an “About Us” page with names, photos and short bios of owners and key staff. Clearly provide contact info throughout the site. Strengthen your use of “trust elements,” such as icons of widely used payment security providers, a variety of payment methods and shipping deals, and professional-looking design. Also, watch out for spelling/grammar mistakes and regularly ensure all links are active. Contact us for more information.

Did you make donations in 2020? There’s still time to get substantiation

- ByPolk & Associates

- Feb, 18, 2021

- All News & Information

- Comments Off on Did you make donations in 2020? There’s still time to get substantiation

To claim a deduction for a donation of $250 or more, you generally need a contemporaneous written acknowledgment from the charity. “Contemporaneous” means the earlier of the date you file your income tax return, or the extended due date of your return. If you made a donation in 2020 but don’t have a written acknowledgment, you can request it from the charity and wait to file your 2020 return until you receive it. Additional rules apply to certain types of donations. Keep in mind that under a 2020 law, taxpayers who don’t itemize deductions can claim a federal income tax write-off for up to $300 of cash contributions to IRS-approved charities for the 2020 tax year.

What are the tax implications of buying or selling a business?

- ByPolk & Associates

- Feb, 18, 2021

- All News & Information

- Comments Off on What are the tax implications of buying or selling a business?

Merger and acquisition activity in many sectors slowed during 2020 due to COVID-19. But analysts expect it to improve in 2021 as the country comes out of the pandemic. If you’re considering buying or selling another business, it’s important to understand the tax implications. For tax purposes, a transaction can basically be structured in two ways: stock (or ownership interest) or assets. For tax and nontax reasons, buyers usually prefer to purchase assets, while sellers generally prefer stock sales. Buying or selling a business may be the largest transaction you’ll ever make, so seek professional tax advice. After a deal is done, it may be too late to get the best tax results. Contact us.

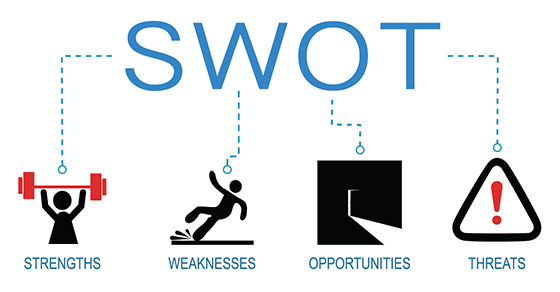

The many uses of a SWOT analysis

- ByPolk & Associates

- Feb, 11, 2021

- All News & Information

- Comments Off on The many uses of a SWOT analysis

Using a strengths, weaknesses, opportunities and threats (SWOT) analysis to frame an important business decision is a long-standing practice. But don’t overlook other uses for it. A SWOT analysis starts by identifying internal strengths and weaknesses that affect business performance. These generally relate to customers’ needs and expectations. Next, the analysis looks at external conditions that could generate a worthwhile return (opportunities) and external factors that could inhibit the company’s performance (threats). Broader applications of SWOT analysis include using it in the context of a business valuation, strategic planning or legal defense. Contact us for more information.

2021 individual taxes: Answers to your questions about limits

- ByPolk & Associates

- Feb, 11, 2021

- All News & Information

- Comments Off on 2021 individual taxes: Answers to your questions about limits

Many people are more concerned about their 2020 tax bills right now than they are about their 2021 tax situations. That’s understandable because your 2020 individual tax return is due to be filed in less than three months (unless you file an extension). However, it’s a good idea to acquaint yourself with tax amounts that […]

Many tax amounts affecting businesses have increased for 2021

- ByPolk & Associates

- Feb, 11, 2021

- All News & Information

- Comments Off on Many tax amounts affecting businesses have increased for 2021

A number of tax-related limits affecting businesses are annually indexed for inflation, and many have increased for 2021. For example, the Section 179 expensing limit has gone up to $1.05 million from $1.04 million for 2020. Health Savings Account (HSA) contributions for individual coverage have increased to $3,600 (from $3,550). HSA family coverage contributions increased $100 to $7,200. Some 2021 amounts have stayed the same due to low inflation. This includes employee contributions to 401(k) plans, which remain $19,500. And the deduction for business-related meals and beverages doubled from 50% to 100% due to a new law. We can answer any questions you have about taxes and your business.

Notice: Fraudulent Michigan form 1099-G for 2020.

- ByPolk & Associates

- Feb, 11, 2021

- All News & Information

- Comments Off on Notice: Fraudulent Michigan form 1099-G for 2020.

Source: Michigan Department of Labor and Economic Opportunity Unemployment benefits are taxable and must be reported on federal and state tax returns. The statements, called 1099-G or “Certain Government Payments,” are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year. Copies of the 1099-G forms are […]

Estimated Tax Penalty and Interest Waiver for Individuals Who Received Unemployment Benefits in Tax Year 2020

- ByPolk & Associates

- Feb, 11, 2021

- All News & Information, COVID-19 Resources

- Comments Off on Estimated Tax Penalty and Interest Waiver for Individuals Who Received Unemployment Benefits in Tax Year 2020

Source: State of Michigan This notice establishes an automatic waiver of all penalty and interest related to estimated taxes owed by individual income taxpayers who received unemployment benefits during tax year 2020. Estimated Payment Obligation. Section 301(1) of the Michigan Income Tax Act requires every person whose annual tax is expected to exceed $500 or more […]

Are your supervisors adept at multigenerational management?

- ByPolk & Associates

- Feb, 04, 2021

- All News & Information

- Comments Off on Are your supervisors adept at multigenerational management?

The COVID-19 pandemic has emphasized the importance of business leadership at every level, including supervisors. Today’s supervisors need to develop flexible styles when dealing with multiple generations. Younger employees (Millennials and Generation Z) tend to have different needs and expectations than older ones (Baby Boomers and Generation X). Although financial security is highly valued by every generation, Millennials and Gen Z may more highly prioritize a well-rounded benefits package, especially mental health benefits. Supervisors should encourage and guide employees to optimally use their benefits. We can help you develop cost-effective strategies for upskilling your supervisors.

The power of the tax credit for buying an electric vehicle

- ByPolk & Associates

- Feb, 04, 2021

- All News & Information

- Comments Off on The power of the tax credit for buying an electric vehicle

Although electric vehicles are a small percentage of the cars on the road today, they’re increasing in popularity. And if you buy one, you may be eligible for a federal tax break. The tax code provides a credit to purchasers of qualifying plug-in electric drive motor vehicles including passenger cars and light trucks. The credit is equal to $2,500 plus an additional amount, based on battery capacity, that can’t exceed $5,000. Therefore, the maximum credit is $7,500. There are a number of requirements to qualify and the credit may not be available because of a per-manufacturer cumulative sales limitation. (Tesla and GM vehicles are no longer eligible.) Contact us if you want more information.

You must be logged in to post a comment.