Eligible Businesses: Claim the Employee Retention Tax Credit

- ByPolk & Associates

- Jun, 30, 2021

- All News & Information

- Comments Off on Eligible Businesses: Claim the Employee Retention Tax Credit

The Employee Retention Tax Credit (ERTC) is a valuable tax break that was extended and modified by the American Rescue Plan Act (ARPA). Originally, the ERTC applied to wages paid after March 12, 2020, and before Jan. 1, 2021. Congress later modified and extended the ERTC to apply to wages paid before July 1, 2021. The ARPA again extended and modified the ERTC to apply to wages paid after June 30, 2021, and before Jan. 1, 2022. The maximum ERTC available is generally $7,000 per employee per calendar quarter or $28,000 per employee in 2021. Other modifications have also been made that may be beneficial to your business. Contact us if you have questions about your business claiming the ERTC.

Are you a nonworking spouse? You may still be able to contribute to an IRA

- ByPolk & Associates

- Jun, 30, 2021

- All News & Information

- Comments Off on Are you a nonworking spouse? You may still be able to contribute to an IRA

Married couples may not be able to save as much as they need for retirement when one spouse doesn’t work outside the home. An IRA contribution is generally only allowed if you earn compensation. But an exception exists. A spousal IRA allows a contribution for a nonworking spouse. For 2021, a couple can contribute $6,000 to an IRA for a nonworking spouse ($7,000 if the spouse will be 50 by the end of the year). However, if in 2021, the working spouse is an active participant in an employer retirement plan, a deductible contribution can be made to the IRA of the nonparticipant spouse only if the couple’s adjusted gross income doesn’t exceed a certain threshold. Contact us for more details.

Critical path method can propel IT projects

- ByPolk & Associates

- Jun, 30, 2021

- All News & Information

- Comments Off on Critical path method can propel IT projects

For many businesses, IT projects look good on paper but get bogged down in “scope creep,” missed deadlines and disagreements. One potential solution is critical path method (CPM), a scheduling technique used to calculate a project’s duration and illustrate how schedules are affected when variables change. It identifies the “critical path,” which is the most efficient sequence of scheduled activities that drives a project to completion. Typically, CPM involves creating a flow chart showing the “activity sequence” and calculating the project timeline. Dedicated CPM software can be used for larger, more complex projects. Contact us for help keeping your IT projects on time and within budget.

Are your company’s job descriptions pulling their weight?

- ByPolk & Associates

- Jun, 24, 2021

- All News & Information

- Comments Off on Are your company’s job descriptions pulling their weight?

Outdated, vague or inaccurate job descriptions can lead to longer hiring times, bad hires, workplace conflicts and even legal exposure. For these reasons, business owners should regularly ask themselves: Are our job descriptions pulling their weight? Conduct a review to determine whether yours are current and comprehensive. As necessary, revise wording to better summarize the duties and responsibilities of a position as it exists today. Use your updated job descriptions to increase organizational efficiency in areas such as recruiting, compensation, workload distribution, cross-training and performance management. Ensure yours are actively contributing to your company’s success.

Traveling for business again? What can you deduct?

- ByPolk & Associates

- Jun, 24, 2021

- All News & Information

- Comments Off on Traveling for business again? What can you deduct?

As we continue to come out of the pandemic, you may be traveling again for business. There are a number of rules for deducting your out-of-town business travel expenses within the U.S. These rules apply if the business reasonably requires an overnight stay. The actual costs of travel (plane fare, cabs, etc.) are deductible for out-of-town business trips. You’re also allowed to deduct the cost of lodging. For 2021 and 2022, the law allows a 100% deduction for food and beverages provided by a restaurant. If a trip is a combined business/pleasure trip, only the cost of meals, lodging, etc., incurred for the business days are deductible (not those incurred for personal vacation days).

Seniors may be able to write off Medicare premiums on their tax returns

- ByPolk & Associates

- Jun, 24, 2021

- All News & Information

- Comments Off on Seniors may be able to write off Medicare premiums on their tax returns

Are you age 65 and older and have basic Medicare insurance? You may need to pay additional premiums to get the level of coverage you want. The premiums can be expensive, especially if you’re married and both you and your spouse are paying them. But there may be a bright side: You may qualify for a tax break for paying the premiums. However, it can be difficult to qualify to claim medical expenses on your tax return. For 2021, you can deduct medical expenses only if you itemize deductions and only to the extent that total qualifying expenses exceeded 7.5% of adjusted gross income. Contact us if you want more information about deducting medical expenses, including Medicare premiums.

Don’t assume your profitable company has strong cash flow

- ByPolk & Associates

- Jun, 24, 2021

- All News & Information

- Comments Off on Don’t assume your profitable company has strong cash flow

Most of us are taught from a young age never to assume anything. A dangerous assumption that many business owners make is that, if their companies are profitable, their cash flow must also be strong. But this isn’t always the case. There are many reasons profits and cash flow might differ, including changes in working capital, fixed assets, financing and owners’ capital. Business owners should look beyond profits to ensure they have enough cash on hand to pay employees, suppliers, lenders and of course the IRS (if necessary). Our firm can help you generate accurate financial statements and glean the most important insights from them, including the distinction between profits and cash flow.

Tax-favored ways to build up a college fund

- ByPolk & Associates

- Jun, 15, 2021

- All News & Information

- Comments Off on Tax-favored ways to build up a college fund

If you’re a parent with a college-bound child, you may want to save with tax-favored vehicles. For example, if used to finance college, eligible families don’t have to report the interest on Series EE U.S. savings bonds for federal tax purposes until the bonds are cashed in. And interest on “qualified” Series EE (and Series I) bonds may be exempt from federal tax if the bond proceeds are used for qualified education expenses. To qualify for the tax exemption, you must purchase bonds in your name (not the child’s) or with your spouse. The proceeds must be used for tuition, fees, etc. and not room and board. The exemption is phased out if your adjusted gross income exceeds certain amounts.

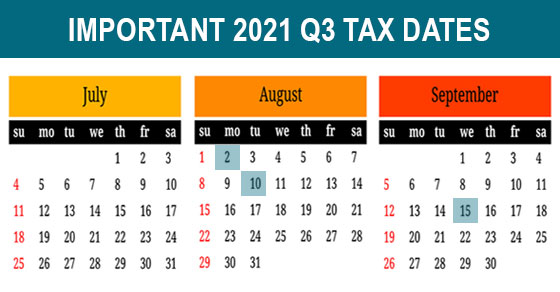

2021 Q3 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Jun, 15, 2021

- All News & Information

- Comments Off on 2021 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some key tax-related deadlines for businesses and other employers during the third quarter of 2021. AUGUST 2: Employers report income tax withholding and FICA taxes for second quarter 2021 (Form 941) and pay any tax due. File a 2020 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension. SEPT. 15: If a calendar-year S corporation or partnership that filed an automatic extension, file a 2020 income tax return. If a calendar-year C corp., pay the third installment of 2021 estimated income taxes. Contact us for more about the filing requirements and to ensure you meet all applicable deadlines.

Retiring soon? 4 tax issues you may face

- ByPolk & Associates

- Jun, 10, 2021

- All News & Information

- Comments Off on Retiring soon? 4 tax issues you may face

If you’re getting ready to retire, you’ll soon experience changes that may have tax implications. For example, if you sell your principal residence to downsize and you have a gain from the sale, you may be able to exclude up to $250,000 of the gain from your income ($500,000 if filing jointly). You may have to take required minimum distributions from retirement accounts and your withdrawals will be generally included in your taxable income (although qualified distributions from Roth accounts are excluded). You also may have to pay tax on your Social Security benefits, depending on your income from other sources. As you can see, tax planning is still important after you retire. We can help.