No parking: Unused compensation reductions can’t go to health FSA

- ByPolk & Associates

- Apr, 27, 2022

- All News & Information

- Comments Off on No parking: Unused compensation reductions can’t go to health FSA

The pandemic’s impact is raising some interesting fringe-benefit questions. In an information letter, the IRS recently answered an inquiry involving a qualified transportation plan participant who now works from home rather than in the office. The participant asked whether he could transfer unused compensation reductions for parking to his health Flexible Spending Account (FSA) offered through a cafeteria plan. The IRS said no, explaining: 1) the U.S. Code prohibits cafeteria plans from offering qualified transportation fringe benefits, and 2) tax rules don’t allow unused compensation reduction amounts under a transportation plan to be transferred to a health FSA. Contact us for more info.

Want to turn a hobby into a business? Watch out for the tax rules

- ByPolk & Associates

- Apr, 27, 2022

- All News & Information

- Comments Off on Want to turn a hobby into a business? Watch out for the tax rules

You may dream of turning a hobby into a business. You won’t have any tax headaches if your new business is profitable. But what if the enterprise consistently generates losses (deductions exceed income) and you claim them on your tax return? The IRS may step in and say it’s a hobby (an activity not engaged in for profit) rather than a business. Then you’ll be unable to deduct losses. There are 2 ways to avoid the hobby loss rules: 1) Show a profit in at least 3 out of 5 consecutive years (2 out of 7 years for certain horse businesses). 2) Run the venture in such a way as to show that you intend to turn it into a profit-maker, rather than operate it as a hobby. Contact us for more details.

The tax mechanics involved in the sale of trade or business property

- ByPolk & Associates

- Apr, 27, 2022

- All News & Information

- Comments Off on The tax mechanics involved in the sale of trade or business property

What are the tax consequences of selling property used in your business? Many rules may apply. Let’s assume the property you want to sell is land or depreciable property used in your business and has been held by you for more than a year. Gains and losses from sales of business property are netted against each other. The net gain or loss qualifies for tax treatment as follows: 1) If the netting of gains and losses results in a net gain, long-term capital gain treatment results, subject to “recapture” rules. Long-term capital gain is generally more favorable than ordinary income. 2) If the netting of gains and losses results in a net loss, the loss is fully deductible against ordinary income.

Businesses looking for outside investors need a sturdy pitch deck

- ByPolk & Associates

- Apr, 20, 2022

- All News & Information

- Comments Off on Businesses looking for outside investors need a sturdy pitch deck

Does your company need funding from outside investors? If so, you need to wow them with your vision, financials and business plan. Many companies produce a digital presentation called a “pitch deck” that describes the business, its primary product or service, and the upside of the investment opportunity. Some general guidelines: 1) Keep it brief, concise and comprehensive, 2) Identify the problem you’re solving and target market, 3) Outline your business plan, 4) Sell investors on your leadership team’s strengths, 5) Summarize your marketing and sales plans, and 6) Provide a snapshot of your financials, both historical results and projections. Contact us for help with your pitch deck.

Thinking about converting your home into a rental property?

- ByPolk & Associates

- Apr, 20, 2022

- All News & Information

- Comments Off on Thinking about converting your home into a rental property?

Some taxpayers move to new homes but rent out their present homes. Renting out a home carries potential tax benefits and pitfalls. You’re generally treated as a landlord once you begin renting your home. That means you must report rental income on your tax return but are entitled to deductions for utilities, incidental repairs, depreciation and other expenses. However, you could forfeit a big tax break if you sell the home at a profit. You can generally escape tax on up to $250,000 ($500,000 for married joint filers) of gain on the sale of a principal home. However, this treatment is conditioned on using the home as your principal residence for at least 2 of the 5 years preceding the sale.

Tax considerations when adding a new partner at your business

- ByPolk & Associates

- Apr, 20, 2022

- All News & Information

- Comments Off on Tax considerations when adding a new partner at your business

Adding a partner in a partnership has several financial and legal implications. Although the entry of a new partner may appear simple, you should plan properly in order to avoid tax problems. For example, if there’s a change in the partners’ interests in unrealized receivables and substantially appreciated inventory items, the change is treated as a sale of the items. The result: The current partners will recognize gain. For this purpose, unrealized receivables include accounts receivable, depreciation recapture and certain other ordinary income items. In order to avoid gain recognition on those items, they must be allocated to the current partners even after the entry of a new partner.

Offering summer job opportunities? Double-check child labor laws

- ByPolk & Associates

- Apr, 13, 2022

- All News & Information

- Comments Off on Offering summer job opportunities? Double-check child labor laws

In News Release No. 22-546-DEN, the U.S. Department of Labor’s Wage and Hour Division recently announced that it’s stepping up efforts to identify child labor violations in the Salt Lake City area. But the news release is a good reminder for companies nationwide. The Fair Labor Standards Act restricts the hours that children under 16 years of age can work and lists hazardous occupations too dangerous for them to perform. The law allows children 14 to 15 years old to work outside of school hours in various non-hazardous jobs, but only under certain conditions and during permissible work hours. The news release describes one case in which an employer was fined $17,159 for violations.

Tax issues to assess when converting from a C corporation to an S corporation

- ByPolk & Associates

- Apr, 13, 2022

- All News & Information

- Comments Off on Tax issues to assess when converting from a C corporation to an S corporation

Although S corporations may provide tax advantages over C corporations, there are a number of potentially costly tax issues that you should assess before making a decision to switch. Here are 4 important issues to consider when converting from a C corp to an S corp: 1) Built-in gains tax; 2) Passive income; 3) LIFO inventories; and 4) Unused losses. There are strategies for eliminating or minimizing some of these tax problems and for avoiding unnecessary pitfalls related to them. But a lot depends upon your company’s particular circumstances. Contact us to discuss the effect of these and other potential problems, along with possible strategies for dealing with them.

Once you file your tax return, consider these 3 issues

- ByPolk & Associates

- Apr, 13, 2022

- All News & Information

- Comments Off on Once you file your tax return, consider these 3 issues

After filing a 2021 tax return, keep these three issues in mind: 1) You can check on your refund by going to irs.gov. Click on “Get Your Refund Status.” 2) Some tax records can now be thrown out. You should generally save statements, receipts, etc. for three years after filing (those related to the 2018 tax year). However, keep the actual returns indefinitely. There are exceptions to the general rule. 3) If you forgot something, you can file an amended tax return. In general, you can file Form 1040-X to claim a refund within three years after the date you filed the original return or within two years of the date you paid the tax, whichever is later. Questions? Contact us.

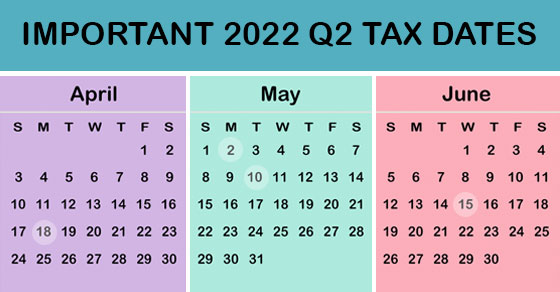

2022 Q2 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Apr, 08, 2022

- All News & Information

- Comments Off on 2022 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some key tax deadlines for businesses during the second quarter of 2022. APRIL 18: If you’re a calendar-year corporation, file a 2021 income tax return (Form 1120) or file for a six-month extension (Form 7004) and pay any tax due. APRIL 18: Corporations pay the first installment of 2022 estimated income taxes. MAY 2: Employers report income tax withholding and FICA taxes for Q1 2022 (Form 941) and pay any tax due. JUNE 15: Corporations pay the second installment of 2022 estimated income taxes. Contact us to learn more about filing requirements and ensure you meet all applicable deadlines.