How to handle evidence in a fraud investigation at your business

- ByPolk & Associates

- Sep, 22, 2022

- All News & Information

- Comments Off on How to handle evidence in a fraud investigation at your business

Every business owner should be prepared to act if any indication of fraud arises. How you handle the evidence could determine whether you’ll be able to prove the charges brought against the alleged perpetrator. Place paper documents in a secure location and don’t mark them up. The fewer people who touch them, the better. Digital evidence generally presents more challenges. Train IT staff to respond quickly and appropriately when fraud is suspected. This includes stopping any routine data destruction immediately. Consider engaging a qualified forensic expert who can restore deleted and altered records, identify digital forgeries, and access password-protected files. Contact us for help.

Don’t forget income taxes when planning your estate

- ByPolk & Associates

- Sep, 22, 2022

- All News & Information

- Comments Off on Don’t forget income taxes when planning your estate

The current federal estate tax exemption ($12.06 million in 2022) means that many people aren’t concerned with estate tax. But they should still plan to save income taxes. For example, be careful making lifetime transfers of appreciated assets. It’s true that the assets and future appreciation generated by them are removed from your estate. But the gift carries a potential income tax cost because the recipient receives your basis upon transfer. He or she could face capital gains tax on the sale of the gifted property in the future. If the appreciated property is held until death, under current law, the heir will get a “step-up” in basis that will reduce or wipe out the capital gains tax.

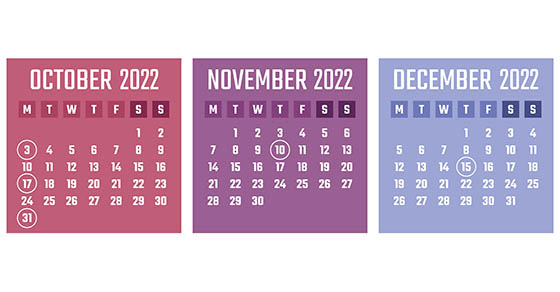

2022 Q4 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Sep, 22, 2022

- All News & Information

- Comments Off on 2022 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some important 4th quarter tax-filing dates for businesses. OCT. 17: If you’re the owner or operator of a calendar-year C corp. which filed an extension, file a 2021 income tax return. OCT. 31: Report income tax withholding and FICA taxes for Q3 2022 (unless you’re eligible for a Nov. 10 deadline because you deposited on time and in full all of the associated taxes due). DEC. 15: If a calendar-year C corp., pay the fourth installment of 2022 estimated income taxes. Note: Certain deadlines may be postponed in federally declared disaster areas. We can provide more information about filing requirements and ensure you’re meeting all applicable deadlines.

Sometimes businesses need to show customers tough love

- ByPolk & Associates

- Sep, 14, 2022

- All News & Information

- Comments Off on Sometimes businesses need to show customers tough love

Every business needs customers or clients to survive. But to truly thrive, evaluate which customers support your company and which ones are dragging it down. There are many ways to do so. If your sales system tracks customer purchases, and your accounting system has good cost accounting or decision support capabilities, the process is simple. Companies that don’t track individual customers can still generally analyze customer segments or products. After you’ve assigned profitability levels to each customer or customer segment, sort them into an A group of optimal customers, a B group of acceptable ones, and a C group that aren’t profitable and you might want to let go. Contact us for help.

Seller-paid points: Can homeowners deduct them?

- ByPolk & Associates

- Sep, 14, 2022

- All News & Information

- Comments Off on Seller-paid points: Can homeowners deduct them?

The National Association of Realtors reports that July 2022 existing home sales were down but prices were up nationwide, compared with 2021. If you’re a homebuyer, you may wonder if you can deduct mortgage points paid on your behalf by the seller. The answer is “yes,” subject to some important limits. For example, the rule allowing a deduction for seller-paid points doesn’t apply to points that are allocated to the part of a mortgage above $750,000 ($375,000 for married filing separately) for tax years 2018 through 2025 (above $1 million for tax years before 2018 and after 2025). It also doesn’t apply to points on a loan used to improve (rather than buy) a home and in other situations.

Want to see into the future? Delve deeper into forecasting

- ByPolk & Associates

- Sep, 09, 2022

- All News & Information

- Comments Off on Want to see into the future? Delve deeper into forecasting

For a company to be truly successful, its ownership needs to attempt the impossible: see into the future. Forecasting key metrics can help keep your business on solid financial footing. Bear in mind that forecasting is generally more accurate in the short term. Depending on your goals, you’ll likely need to choose between: 1) quantitative methods, which rely on historical data, and 2) qualitative methods, which rely on expert opinions instead of company-specific info. Consider investing in forecasting software, which allows you to plug many additional variables into the equation. If your company maintains extensive inventory, be particularly diligent about forecasting. Contact us for help.

Is your income high enough to owe two extra taxes?

- ByPolk & Associates

- Sep, 09, 2022

- All News & Information

- Comments Off on Is your income high enough to owe two extra taxes?

High-income taxpayers may face the 3.8% net investment income tax (NIIT). The NIIT applies, in addition to income tax, on your net investment income. It only affects taxpayers with adjusted gross income exceeding $250,000 for joint filers, $200,000 for single taxpayers and heads of household, and $125,000 for married individuals filing separately. The income that’s subject to the NIIT includes interest, dividends, annuities, royalties, rents and net gains from property sales. Wage income and income from an active trade or business isn’t included. However, passive business income is subject to the NIIT. Questions? Contact us to discuss this tax and how its impact may be reduced.

Year-end tax planning ideas for your small business

- ByPolk & Associates

- Sep, 09, 2022

- All News & Information

- Comments Off on Year-end tax planning ideas for your small business

With Labor Day past us, it’s a good time to start thinking about making moves that may help lower your small business taxes for 2022 and 2023. A standard year-end approach is to defer income and accelerate deductions to minimize taxes, as well as to bunch deductible expenses into this year or next to maximize their tax value. Other ideas: Buy eligible equipment and place it in service by Dec. 31 to claim a Section 179 or 100% bonus depreciation deduction. Eligible businesses also may be able to defer income or accelerate deductions to keep income under certain thresholds to claim a qualified business income deduction. Contact us for year-end tax-saving strategies that work for your business.

Make marketing better with a brand audit

- ByPolk & Associates

- Aug, 31, 2022

- All News & Information

- Comments Off on Make marketing better with a brand audit

Your business brand is more than just a logo. It’s a distinctive combination of identifiers that represents who you are, what you do and how you operate. To assess the strength of their brands and improve marketing strategies, many companies conduct a brand audit. There are various ways to conduct one, but most audits have certain things in common. First, they rely on information already on hand or relatively easy to generate such as sales data, website analytics and social media interactions. They also usually involve surveying customers with various brand-related questions. A brand-focused employee survey can also be useful. Contact us for help assessing the costs of a brand audit.

The Inflation Reduction Act: what’s in it for you?

- ByPolk & Associates

- Aug, 31, 2022

- All News & Information

- Comments Off on The Inflation Reduction Act: what’s in it for you?

The Inflation Reduction Act (IRA), which was signed into law recently, contains, extends and modifies many climate and energy-related tax credits. For example, there’s a credit for a percentage of certain expenses for nonbusiness energy-saving property placed in service before Jan. 1, 2033. The credit is further increased for amounts spent for a home energy audit (up to $150). In addition, the IRA repeals the lifetime credit limitation, and instead limits the credit to $1,200 per taxpayer, per year. There are also annual limits for certain types of property. Contact us if you have questions about taking advantage of this or other tax credits in the IRA.