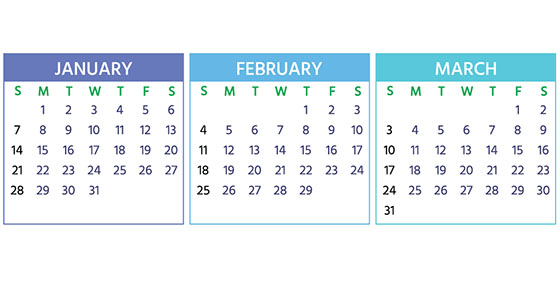

2024 Q1 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Dec, 20, 2023

- All News & Information

- Comments Off on 2024 Q1 tax calendar: Key deadlines for businesses and other employers

Here are a few key tax-related deadlines for businesses during the first quarter of 2024. JAN. 16: Pay the final installment of 2023 estimated tax. JAN. 31: File 2023 Forms W-2 with the Social Security Administration and provide copies to employees. Also provide copies of 2023 Forms 1099-NEC to recipients and file them with the IRS. FEB. 28: File 2023 Forms 1099-MISC if paper filing. (Otherwise, the filing deadline is April 1.) MARCH 5: If a calendar-year partnership or S corp., file or extend your 2023 tax return. Contact us to learn more about filing requirements and ensure you’re meeting all applicable deadlines.

How businesses can get better at data capture

- ByPolk & Associates

- Dec, 13, 2023

- All News & Information

- Comments Off on How businesses can get better at data capture

Almost every kind of business today is data-driven. For this very reason, “data capture” has become a critical yet often overlooked capability of most companies. Simply put, data capture is the process of extracting information from a physical source and converting it into a digital format. Of course, it doesn’t work the same way for every company. That’s why you should identify your mission-critical data and where it comes from. Also train and equip your employees to optimally capture data. Naturally, you must also secure your data so hackers and unauthorized users can’t corrupt, steal or kidnap it in a ransomware attack. Contact us for help managing your company’s technology costs.

The “nanny tax” must be paid for nannies and other household workers

- ByPolk & Associates

- Dec, 13, 2023

- All News & Information

- Comments Off on The “nanny tax” must be paid for nannies and other household workers

You may have heard of the “nanny tax.” But if you don’t employ a nanny, you may think it doesn’t apply to you. Check again. Hiring a housekeeper or other household employee (who isn’t an independent contractor) may make you liable for federal income tax, Social Security and Medicare (FICA) tax and unemployment tax. You may also have state tax obligations. In 2023, you must withhold and pay FICA taxes if your worker earns cash wages of $2,600 or more. This will increase to $2,700 in 2024. You pay household worker obligations by increasing quarterly estimated tax payments or increasing withholding from wages (not by paying a lump sum). Employment taxes are then reported on your tax return.

Giving gifts and throwing parties can help show gratitude and provide tax breaks

- ByPolk & Associates

- Dec, 13, 2023

- All News & Information

- Comments Off on Giving gifts and throwing parties can help show gratitude and provide tax breaks

It’s holiday time again! Your business may want to show its appreciation to employees and customers by giving them gifts or hosting parties. It’s important to understand the tax implications. Are the expenses tax deductible by your business and taxable to the recipients? Gifts to customers are generally deductible up to $25 per recipient, per year. “De minimis” noncash gifts to employees (such as a holiday turkey) aren’t included in their taxable income but are deductible by your business. Holiday parties are 100% deductible if they’re primarily for the benefit of employees who aren’t highly paid and their families. Holiday cards are also likely to be deductible. Contact us with questions.

Is your business underestimating the value of older workers?

- ByPolk & Associates

- Dec, 13, 2023

- All News & Information

- Comments Off on Is your business underestimating the value of older workers?

When hiring, underestimating the value of older workers could represent a costly blind spot for your business. This segment of the workforce tends to have many positive attributes, including being experienced, budget-savvy, well-connected and self-motivated. Adding older workers can present challenges to company culture, however, so be ready to communicate well and perhaps adjust your approach to onboarding. Emphasize your commitment to an equitable approach to hiring and performance management. Also consider providing training to managers, who might find themselves supervising workers with longer employment histories. Contact us for help managing your company’s employment costs.

4 ideas that may help reduce your 2023 tax bill

- ByPolk & Associates

- Dec, 13, 2023

- All News & Information

- Comments Off on 4 ideas that may help reduce your 2023 tax bill

You may still have time to cut your 2023 federal tax liability by taking certain steps. For example, contribute the maximum to your retirement plans, including traditional IRAs and SEP plans. Another idea: If you make your Jan. 2024 mortgage payment in December, you can deduct the interest portion on your 2023 tax return (assuming you itemize deductions). You can also make charitable contributions (if you itemize) and “harvest” any investment losses by Dec. 31. If you have more losses than gains, you generally can apply up to $3,000 of the excess to reduce your ordinary income. Remaining losses are carried forward to future tax years. Contact us with questions about your 2023 tax liability.

A company car is a valuable perk but don’t forget about taxes

- ByPolk & Associates

- Dec, 13, 2023

- All News & Information

- Comments Off on A company car is a valuable perk but don’t forget about taxes

One of the most appreciated fringe benefits for owners and employees of small businesses is the use of a company car. This perk results in tax deductions for the employer and tax breaks for the owners and employees using the cars. (And of course, they enjoy the nontax benefit of using a company car.) For tax deduction purposes, a business treats the car much the same way it would any other business asset. Providing an auto for an owner or key employee comes with complications and paperwork. Personal use needs to be tracked and valued under the fringe benefit tax rules and treated as income. Contact us for assistance. We can help keep you in compliance with the rules.

Solving the riddles of succession planning for family businesses

- ByPolk & Associates

- Dec, 01, 2023

- All News & Information

- Comments Off on Solving the riddles of succession planning for family businesses

Every established business will encounter challenges when it comes to succession planning. Family-owned companies, however, often face particularly complex issues. If yours is a family business, always bear in mind that there are solutions to be found. For example, an installment sale of the company to children or other family members can provide liquidity for owners while easing the financial burden on children and grandchildren. Alternatively, owners may transfer business interests to a grantor retained annuity trust (GRAT) to obtain gift and estate tax benefits, provided they survive the trust term. A GRAT also provides a fixed income stream for a certain period. Contact us for more info.

Don’t forget to empty out your flexible spending account

- ByPolk & Associates

- Dec, 01, 2023

- All News & Information

- Comments Off on Don’t forget to empty out your flexible spending account

If you have a tax-saving flexible spending account (FSA) with your employer to help pay for health or dependent care expenses, it’s a good time to review 2023 expenses. A pre-tax contribution of $3,050 to a health FSA is permitted in 2023. This is increasing to $3,200 for 2024. To avoid forfeiting your health FSA funds because of a “use-it-or-lose-it” rule, you must make eligible medical expenditures by the last day of the plan year (Dec. 31 for a calendar year plan), unless the plan allows an optional grace period. Like health FSAs, dependent care FSAs are also generally subject to a use-it-or-lose-it rule. They generally have a $5,000 maximum annual contribution. Other rules may apply.

Key 2024 inflation-adjusted tax parameters for small businesses and their owners

- ByPolk & Associates

- Dec, 01, 2023

- All News & Information

- Comments Off on Key 2024 inflation-adjusted tax parameters for small businesses and their owners

The IRS recently announced various inflation-adjusted federal income tax amounts for next year, including those for Section 179 deductions. For tax years beginning in 2024, small businesses can potentially write off up to $1,220,000 of qualified asset additions in year one (up from $1,160,000 for 2023). However, the maximum deduction amount begins to be phased out once qualified asset additions exceed $3,050,000 (up from $2,890,000 for 2023). Various limitations apply to these deductions. Also, keep in mind that under the (separate) bonus depreciation break, you can deduct up to 60% of the cost of qualified asset additions placed in service in 2024. For 2023, you could deduct up to 80%.