What hospitals in financial distress should do now to avoid closing down

- ByPolk & Associates

- Jun, 27, 2018

- All News & Information, Health Care

- Comments Off on What hospitals in financial distress should do now to avoid closing down

Doing a full financial assessment is key to forecasting financial distress but there’s more to it than looking at cash flow ratios and profitability.

ACP calls for continued efforts in reducing excessive physician administrative burden

- ByPolk & Associates

- Jun, 27, 2018

- All News & Information, Health Care

- Comments Off on ACP calls for continued efforts in reducing excessive physician administrative burden

Nearly two-thirds of U.S. physicians report feeling burned-out, depressed or both, affecting their relationships with patients and colleagues.

Mergers, acquisitions playing role in achieving scale, marketplace competition

- ByPolk & Associates

- Jun, 27, 2018

- All News & Information, Health Care

- Comments Off on Mergers, acquisitions playing role in achieving scale, marketplace competition

More than half of senior executives cite market share as the primary driver behind their moves toward consolidation.

Run the numbers before you extend customer credit

- ByPolk & Associates

- Jun, 21, 2018

- All News & Information

- Comments Off on Run the numbers before you extend customer credit

Funny thing about customers: They can keep you in business, but can also put you out of it. The latter circumstance may occur if you overrely on a few customers that abuse their credit. To prevent this, keep your credit application form comprehensive and updated. When working with private companies, request financial statements and look at metrics such as profit margin (net income divided by net sales). From the balance sheet, calculate current ratio (current assets divided by current liabilities). For more help assessing customers’ creditworthiness, contact us.

Consider the tax advantages of investing in qualified small business stock

- ByPolk & Associates

- Jun, 21, 2018

- All News & Information

- Comments Off on Consider the tax advantages of investing in qualified small business stock

Investing in qualified small business (QSB) stock offers some attractive tax advantages, especially considering that the TCJA didn’t cut long-term capital gains rates: If you buy QSB stock in 2018 and hold it beyond the 5-year mark in 2023, you can enjoy 100% exclusion of gain when you sell it. If you don’t want to hold the stock that long but within 60 days of selling it you buy other QSB stock with the proceeds, you can defer tax on the gain until you sell the new stock. Contact us for more about the various rules that apply and other important considerations.

2018 Q3 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Jun, 21, 2018

- All News & Information

- Comments Off on 2018 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some key tax-related deadlines for businesses and other employers during Quarter 3 of 2018. JULY 31: Report income tax withholding and FICA taxes for Q2 2018 (unless eligible for Aug. 10 deadline). File a 2017 calendar-year retirement plan report or request an extension. SEPT. 17: If a calendar-year partnership or S corp. that filed an extension, file a 2017 income tax return. If a calendar-year C corp., pay third installment of 2018 estimated income taxes. Contact us for more about the filing requirements and to ensure you meet all applicable deadlines.

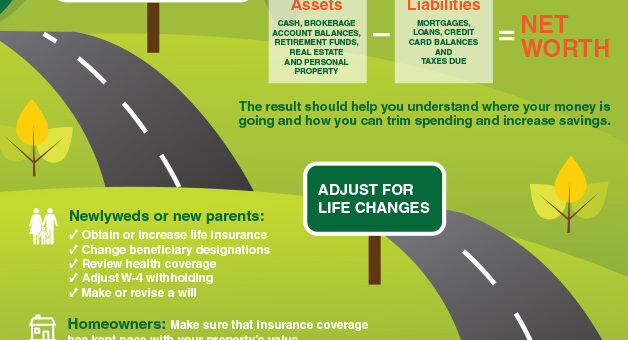

Tools to help you reach major financial goals.

- ByPolk & Associates

- Jun, 21, 2018

- All News & Information

- Comments Off on Tools to help you reach major financial goals.

Polk & AssociatesLarge enough to serve a diverse clientele, yet small enough to maintain a hands-on approach, we are committed to maintaining the highest accounting and ethical standards with continuous education, extensive research resources, and excellent quality control. Polk and Associates is a member of the Michigan Association of Certified Public Accountants, and the American […]

Marketing to Multiple Generations

- ByPolk & Associates

- Jun, 21, 2018

- All News & Information, Real Estate

- No Comments

Today’s renter pool comprises a wide range of ages that can pose challenges to developers, owners and operators. Eric Clark of Bainbridge Cos. shares four tips on how communities can appeal to anyone.

Keeping Rents Affordable After Upgrading

- ByPolk & Associates

- Jun, 21, 2018

- All News & Information, Real Estate

- Comments Off on Keeping Rents Affordable After Upgrading

Investors benefit by keeping rents affordable following renovations.

Focus in Student Housing Amenities Changes from Luxury to Health and Wellness

- ByPolk & Associates

- Jun, 21, 2018

- All News & Information, Real Estate

- Comments Off on Focus in Student Housing Amenities Changes from Luxury to Health and Wellness

Some companies that provide student housing say they have seen a shift away from over-the-top amenities that were popular with off-campus renters a few years back.

You must be logged in to post a comment.