Michigan lawmaker calling for Michigan income tax filing deadline to be extended

- ByPolk & Associates

- Mar, 26, 2020

- COVID-19 Resources

- Comments Off on Michigan lawmaker calling for Michigan income tax filing deadline to be extended

LANSING, Mich – Rep. Shane Hernandez is calling for the State of Michigan to move back its income tax filing deadline to July 15, mirroring a recent move by the federal government sparked by the coronavirus crisis. Hernandez called on Gov. Gretchen Whitmer to make the change, but said he is ready to pursue the […]

IRS Clarifies 2020 filing requirements

- ByPolk & Associates

- Mar, 26, 2020

- COVID-19 Resources

- Comments Off on IRS Clarifies 2020 filing requirements

Key points The filing and payment deadline for individual and business returns and payments due on April 15th has been extended to July 15th 2020 Payment extension is not allowed for amounts in excess of 1mm (including 1st quarter 2020 estimate) Can extend filing (not payment on July 15th to October 15th 2020 Contributions to […]

SBA offering loans to small businesses hit hard by COVID-19

- ByPolk & Associates

- Mar, 25, 2020

- All News & Information, COVID-19 Resources

- Comments Off on SBA offering loans to small businesses hit hard by COVID-19

If your small business has been hurt by the outbreak of the coronavirus (COVID-19), the Small Business Administration is offering some financial relief. The agency has announced the availability of Economic Injury Disaster Loans under the Coronavirus Preparedness and Response Supplemental Appropriations Act. Each state’s governor can submit a request for assistance, the criteria for which have been relaxed. Once approved, the loans may provide up to $2 million in financial assistance to small businesses anywhere in the state. The interest rate is 3.75% for qualifying companies and 2.75% for eligible nonprofits. Terms vary based on a borrower’s ability to repay. Contact us for more info.

Individuals get coronavirus (COVID-19) tax and other relief

- ByPolk & Associates

- Mar, 25, 2020

- All News & Information, COVID-19 Resources

- Comments Off on Individuals get coronavirus (COVID-19) tax and other relief

Taxpayers now have more time to file their returns and pay any tax owed because of the coronavirus (COVID-19) pandemic. The IRS announced that the filing due date is automatically extended from April 15, 2020, to July 15, 2020. Taxpayers can also defer making federal income tax payments, due on April 15 until July 15, without penalties and interest, regardless of the amount they owe. The deferment applies to individuals, trusts, estates, corporations, other non-corporate tax filers and those who pay self-employment tax. They can also defer their initial quarterly estimated federal income tax payments for the 2020 tax year from the April 15 deadline until July 15. Contact us with questions.

IRS Clarifies Payment Extension | Due date remains April 15

- ByPolk & Associates

- Mar, 20, 2020

- All News & Information, COVID-19 Resources

- Comments Off on IRS Clarifies Payment Extension | Due date remains April 15

The IRS issued Notice 2020-17 clarifying the recent announcement by Treasury Secretary Mnuchin extending tax payments. The due date for filing 2019 federal income tax returns remains April 15 absent a valid extension. We do not know if there will be a failure to file penalty if an extension or return is not submitted by […]

What the Senate’s Passage of the Families First Coronavirus Response Act Means for You

- ByPolk & Associates

- Mar, 19, 2020

- All News & Information, COVID-19 Resources

- Comments Off on What the Senate’s Passage of the Families First Coronavirus Response Act Means for You

The bill will become law 15 days after President Trump signs it, which he’s promised to do. Just a few days ago, the House passed the Families First Coronavirus Response Act (FFCRA) and then changed it to make the Senate happy. Today, the Senate passed the revised version without changes. Once President Trump signs this $100 billion […]

SBA to Provide Disaster Assistance Loans for Small Businesses Impacted by Coronavirus (COVID-19)

- ByPolk & Associates

- Mar, 18, 2020

- All News & Information, COVID-19 Resources

- Comments Off on SBA to Provide Disaster Assistance Loans for Small Businesses Impacted by Coronavirus (COVID-19)

WASHINGTON – SBA Administrator Jovita Carranza issued the following statement today in response to the President’s address to the nation: “The President took bold, decisive action to make our 30 million small businesses more resilient to Coronavirus-related economic disruptions. Small businesses are vital economic engines in every community and state, and they have helped make our economy the […]

Federal loans aim to help small businesses survive coronavirus slowdown

- ByPolk & Associates

- Mar, 18, 2020

- All News & Information, COVID-19 Resources

- Comments Off on Federal loans aim to help small businesses survive coronavirus slowdown

Washington — Michigan officials are seeking a declaration from the federal government that would make low-interest disaster loans available to the state’s small businesses that are struggling as the coronavirus pandemic slows consumer spending. Gov. Gretchen Whitmer on Monday officially notified the U.S. Small Business Administration that she is seeking an Economic Injury Disaster Loan Declaration for the state, […]

Disaster relief for small business and employees

- ByPolk & Associates

- Mar, 18, 2020

- All News & Information, COVID-19 Resources

- Comments Off on Disaster relief for small business and employees

LANSING, Mich. (WLUC) – Monday, Governor Gretchen Whitmer signed Executive Order 2020-10 to temporarily expand eligibility for unemployment benefits. This executive order is effective immediately and until Tuesday, April 14 at 11:59 p.m. Under the governor’s order, unemployment benefits would be extended to: Workers who have an unanticipated family care responsibility, including those who have childcare […]

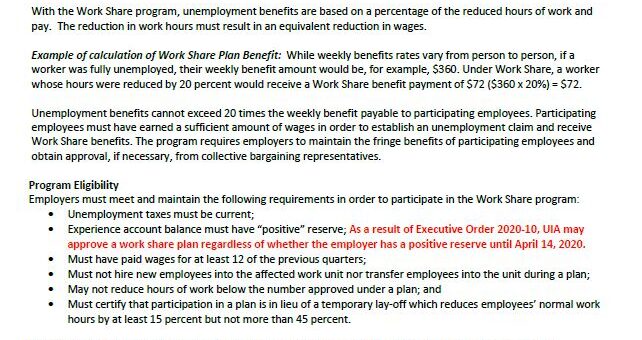

An Alternative to Layoffs

- ByPolk & Associates

- Mar, 18, 2020

- All News & Information, COVID-19 Resources

- Comments Off on An Alternative to Layoffs

Polk & AssociatesLarge enough to serve a diverse clientele, yet small enough to maintain a hands-on approach, we are committed to maintaining the highest accounting and ethical standards with continuous education, extensive research resources, and excellent quality control. Polk and Associates is a member of the Michigan Association of Certified Public Accountants, and the American […]

You must be logged in to post a comment.