2020 Q1 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Dec, 13, 2019

- All News & Information

- Comments Off on 2020 Q1 tax calendar: Key deadlines for businesses and other employers

Here are a few key tax-related deadlines for businesses during Q1 of 2020. JAN. 31: File 2019 Forms W-2 with the Social Security Administration and provide copies to employees. Also provide copies of 2019 Forms 1099-MISC to recipients and, if reporting nonemployee compensation in Box 7, file, too. FEB. 28: File 2019 Forms 1099-MISC if not required earlier and paper filing. MAR. 16: If a calendar-year partnership or S corp., file or extend your 2019 tax return. Contact us to learn more about filing requirements and ensure you’re meeting all applicable deadlines.

Look in the mirror and identify your company culture

- ByPolk & Associates

- Dec, 13, 2019

- All News & Information

- Comments Off on Look in the mirror and identify your company culture

People are paying more attention to company culture when deciding whether to buy from a business or involve themselves with it. Two University of Michigan professors developed the Organizational Culture Assessment Instrument, which defines four common business cultures: 1) Clan; a close, family-like culture typical to start-ups and small businesses, 2) Adhocracy; a dynamic, creative culture focused on innovation, 3) Market; a results-driven, competitive culture bent on domination, and 4) Hierarchy; a formal, structured culture that values process-following and stability. Which one are you? Bear in mind that most businesses exhibit a mixture of the four styles, with one type dominant.

2 valuable year-end tax-saving tools for your business

- ByPolk & Associates

- Dec, 13, 2019

- All News & Information

- Comments Off on 2 valuable year-end tax-saving tools for your business

Under current law, there are two valuable depreciation-related tools that may help your business reduce its 2019 tax liability. To benefit from the Sec. 179 and bonus depreciation deductions, you must buy eligible machinery, equipment, furniture or other assets and place them into service by the end of the tax year. In other words, you can claim a full deduction for 2019 (up to certain limits) even if you acquire assets and place them in service during the last days of the year. It’s important to note that these deductions may also be used for business vehicles. But, depending on the type of vehicle, additional limits may apply. Please contact us to learn more.

Medical expenses: What it takes to qualify for a tax deduction

- ByPolk & Associates

- Dec, 13, 2019

- All News & Information

- Comments Off on Medical expenses: What it takes to qualify for a tax deduction

Medical services and prescriptions are expensive. You may be able to deduct some expenses on your tax return but the rules make it difficult for many people to qualify. You may be able to time certain medical expenses to your tax advantage. For 2019, the medical expense deduction can only be claimed to the extent unreimbursed costs exceed 10% of your adjusted gross income. You also must itemize deductions. If your total itemized deductions will exceed your standard deduction, moving nonurgent medical procedures and other expenses into 2019 may allow you to exceed the 10% floor. This might include refilling prescriptions, buying eyeglasses, going to the dentist and getting elective surgery.

Bridging the gap between budgeting and risk management

- ByPolk & Associates

- Nov, 22, 2019

- All News & Information

- Comments Off on Bridging the gap between budgeting and risk management

At many companies, a wide gulf exists between budgeting and risk management. There are several general types of threats to assess as you draw up next year’s budget. First, think about competitive risks. You may need to spend more on marketing and advertising to compete against a tough rival, or you could be able to channel more dollars into production if you’re in a strong market position. Also identify compliance risks. How will regulatory rules change next year and what will be the impact on your budget? Last, consider internal risks. Arguably the biggest of these is fraud, but also look into hiring, training and technology costs. Let us help you with the process from start to finish.

What is your taxpayer filing status?

- ByPolk & Associates

- Nov, 22, 2019

- All News & Information

- Comments Off on What is your taxpayer filing status?

When you file your tax return, you do so with one of five filing statuses. It’s possible that more than one status will apply. The box checked on your return generally depends in part on whether you’re unmarried or married on December 31. Here are the filing statuses: Single, married filing jointly, married filing separately, head of household and qualifying widow(er) with a dependent child. Head of household status can be more favorable than filing as a single person, but special rules apply. You must generally be unmarried, have a qualifying child (or dependent relative) and meet certain rules involving “maintaining a household.” If you have questions about your filing status, contact us.

The tax implications if your business engages in environmental cleanup

- ByPolk & Associates

- Nov, 22, 2019

- All News & Information

- Comments Off on The tax implications if your business engages in environmental cleanup

If your company needs to “remediate” or clean up environmental contamination, the expenses involved can be tax deductible. Unfortunately, every type of environmental cleanup expense cannot be currently deducted. Some cleanup costs must be capitalized. For example, remediation costs generally have to be capitalized if the remediation adds significantly to the value of the cleaned-up property; prolongs the useful life of the property; or adapts it to a new or different use. In addition to federal tax deductions, there may be state or local tax incentives involved in cleaning up contaminated property. If you have environmental cleanup expenses, we can help maximize the deductions available.

3 key traits of every successful salesperson

- ByPolk & Associates

- Nov, 14, 2019

- All News & Information

- Comments Off on 3 key traits of every successful salesperson

Every business needs to set performance management standards for its sales department. These standards help drive productivity and, thereby, profitability. Focus on the three key traits of successful salespeople. First, there’s aptitude. Not everyone is cut out for sales. An employee who’s a bad fit could be moved to another department or simply let go. The second trait is effective tactics. Although there are many ways to sell, a good salesperson builds lasting and fruitful relationships with customers. The third trait is strong numbers. Identify and track sales metrics that are fair to your staff and reflect the strategic goals of the business. We can help you crunch the numbers.

Using your 401(k) plan to save this year and next

- ByPolk & Associates

- Nov, 14, 2019

- All News & Information

- Comments Off on Using your 401(k) plan to save this year and next

Does your employer offer a 401(k) or Roth 401(k) plan? Contributing to it is a taxwise way to build a nest egg. If you’re not already socking away the maximum allowed, consider increasing your contribution between now and year end. With a 401(k), an employee elects to have a certain amount of pay deferred and contributed by an employer on his or her behalf to the plan. The contribution limit for 2019 is $19,000. Employees age 50 or older by year end are also permitted to make additional “catch-up” contributions of $6,000, for a total limit of $25,000 in 2019. The IRS just announced that the 401(k) contribution limit for 2020 will increase to $19,500 (plus the $6,000 catch-up contribution).

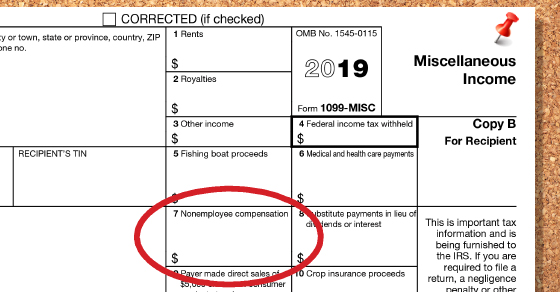

Small businesses: Get ready for your 1099-MISC reporting requirements

- ByPolk & Associates

- Nov, 14, 2019

- All News & Information

- Comments Off on Small businesses: Get ready for your 1099-MISC reporting requirements

Early next year, your business may be required to comply with Form 1099 rules. You may have to send forms to independent contractors, vendors and others whom you pay nonemployee compensation, as well as file them with the IRS. There are penalties for noncompliance. Employers must provide a Form 1099-MISC for nonemployee compensation by Jan. 31, 2020, to each noncorporate service provider who was paid at least $600 for services during 2019. (1099-MISCs generally don’t have to be provided to corporate service providers.) A copy of each Form 1099-MISC with payments listed in box 7 must also be filed with the IRS by Jan. 31. If you have questions about your reporting requirements, contact us.