An Alternative to Layoffs

- ByPolk & Associates

- Mar, 18, 2020

- All News & Information, COVID-19 Resources

- Comments Off on An Alternative to Layoffs

Polk & AssociatesLarge enough to serve a diverse clientele, yet small enough to maintain a hands-on approach, we are committed to maintaining the highest accounting and ethical standards with continuous education, extensive research resources, and excellent quality control. Polk and Associates is a member of the Michigan Association of Certified Public Accountants, and the American […]

Coronavirus Communication Update

- ByPolk & Associates

- Mar, 16, 2020

- All News & Information, COVID-19 Resources

- Comments Off on Coronavirus Communication Update

To Our Clients, Our top priority remains with the health and safety of our clients and our staff, during the coronavirus outbreak and flu season in general. As we have mentioned in earlier communications, we at Polk have invested significantly in order to take advantage of improvements in technology and Go Green. An additional advantage […]

How’s your buy-sell agreement doing these days?

- ByPolk & Associates

- Mar, 04, 2020

- All News & Information

- Comments Off on How’s your buy-sell agreement doing these days?

Most companies wouldn’t go into business without property or liability insurance. Businesses with multiple owners need to use an additional risk-management tool: the buy-sell agreement. If yours has yet to create one, start the process as soon as possible. Even if you have a buy-sell, there are a couple elements to regularly review: funding and valuation. For many businesses, payouts for a buy-sell agreement are funded with life insurance or disability buyout insurance. Look carefully at the policy’s details in relation to the agreement. A valuation should be performed upon creation of the buy-sell and periodically thereafter to assess changes in company value. Contact us for more info.

Home is where the tax breaks might be

- ByPolk & Associates

- Mar, 04, 2020

- All News & Information

- Comments Off on Home is where the tax breaks might be

If you own a home, the interest you pay on your home mortgage may provide a tax break. However, many people believe that any interest paid on home mortgage loans is deductible. Unfortunately, that’s not true. First, you must itemize deductions in order to deduct mortgage interest. And the deduction is limited. From 2018-2025, you can’t deduct the interest for mortgage acquisition debt greater than $750,000 ($375,000 for married taxpayers filing separately). From 2018-2025, there’s no deduction for home equity debt interest. But interest may be deductible on a home equity loan, home equity credit line, etc., if the proceeds are used to substantially improve or construct the home.

Work Opportunity Tax Credit extended through 2020

- ByPolk & Associates

- Mar, 04, 2020

- All News & Information

- Comments Off on Work Opportunity Tax Credit extended through 2020

A recent tax law extended a credit for hiring people from targeted groups. Employers can qualify for the Work Opportunity Tax Credit (WOTC), which is worth as much as $2,400 for each eligible employee, including ex-felons and from other groups. The credit amounts are different for some employees ($4,800, $5,600 and $9,600 for certain veterans; $9,000 for long-term family assistance recipients; and $1,200 for summer youth employees). The WOTC was set to expire on Dec. 31, 2019. But a law passed late last year extends it through Dec. 31, 2020. Contact us with questions or information about your situation.

Gen Z Residents Reshape Multifamily Operations

- ByPolk & Associates

- Feb, 27, 2020

- Real Estate

- Comments Off on Gen Z Residents Reshape Multifamily Operations

This cohort is 44 million strong, extremely tech-savvy and used to instant results. Are you prepared to handle their living needs?

Multifamily market expected to grow in 2020

- ByPolk & Associates

- Feb, 27, 2020

- Real Estate

- Comments Off on Multifamily market expected to grow in 2020

Following a record-setting 2019, the apartment market is predicted to see more new builds

Protecting Your Legacy: Creating a Self-Storage Business Succession Plan

- ByPolk & Associates

- Feb, 27, 2020

- Real Estate

- Comments Off on Protecting Your Legacy: Creating a Self-Storage Business Succession Plan

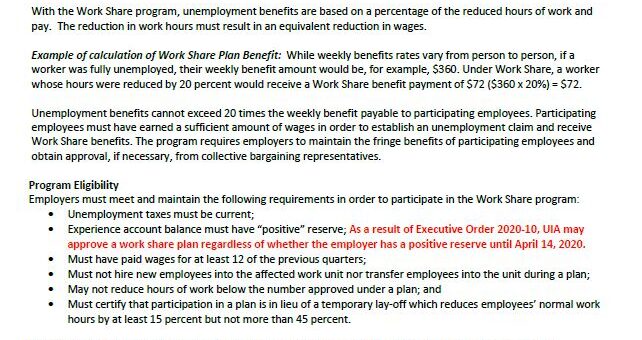

Part of being a good self-storage owner is having a succession plan in place in case you’re unable or no longer want to steer the ship. Here are four common methods of transfer to explore so your business will be protected.

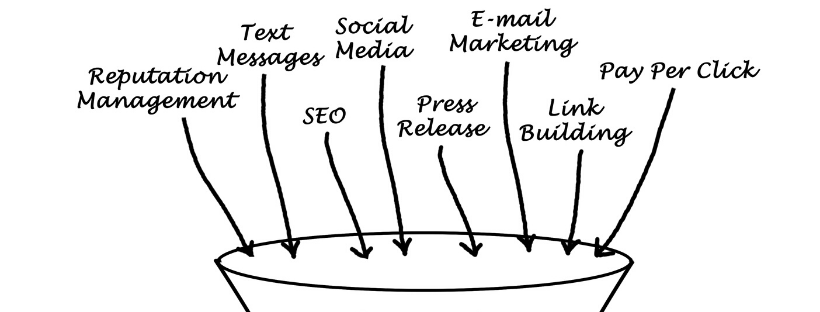

What is funneling, and how can it work for your dental practice?

- ByPolk & Associates

- Feb, 27, 2020

- Health Care

- Comments Off on What is funneling, and how can it work for your dental practice?

Funneling is a campaign designed to draw in potential patients so they learn about your dental practice and its services. Shay Berman says once patients show interest, you keep funneling so that they want to make that all-important appointment.

How to calculate ROI for dental technology

- ByPolk & Associates

- Feb, 27, 2020

- Health Care

- Comments Off on How to calculate ROI for dental technology

Dr. Chris Salierno reminds dentists they don’t have to rely on their instincts to make big investment and technology decisions. Calculating an ROI formula can work wonders in determining how a practice’s dollars should be spent. Get started now.

You must be logged in to post a comment.