Worried about an IRS audit? Prepare in advance

- ByPolk & Associates

- Oct, 05, 2022

- All News & Information

- Comments Off on Worried about an IRS audit? Prepare in advance

IRS audit rates are historically low, according to a recent GAO report (https://bit.ly/3SLZ9Sb). That’s little consolation if your return is selected. But with proper preparation, you should fare well. It helps to know what might catch the attention of the IRS. For example, some audit “red flags” are unusually high deductions, major inconsistencies between previous years’ tax returns and the current one, profit margins and expenses markedly different from those of similar businesses. The IRS normally has three years in which to conduct an audit. If the IRS selects you for an audit, we can help you understand the issues, gather the needed documents and respond to the inquiries effectively.

Investing in the future with a 529 education plan

- ByPolk & Associates

- Oct, 05, 2022

- All News & Information

- Comments Off on Investing in the future with a 529 education plan

If you have a child or grandchild who’s heading to college in the future, you may wonder about investing in a qualified tuition program or 529 plan. You don’t get a federal tax deduction for a contribution, but the earnings aren’t taxed while the funds are in the program. (There may be a state deduction in your state.) You can change the beneficiary without income tax consequences. Distributions are tax-free up to the amount of the qualified higher education expenses. These include tuition (including up to $10,000 in tuition for an elementary or secondary public school), fees, books, supplies and required equipment. Room and board is also a qualified expense if enrolled at least half time.

Formalizing your business’s BYOD policy

- ByPolk & Associates

- Oct, 03, 2022

- All News & Information

- Comments Off on Formalizing your business’s BYOD policy

Many businesses have established bring your own device (BYOD) policies regarding employees’ use of personal phones, tablets, laptops and other tech. It’s a good idea to regularly review and, if necessary, formalize yours. A comprehensive BYOD policy needs to anticipate a multitude of situations, such as voluntary or involuntary terminations and what to do if a device is lost, shared or recycled. Clarify who pays the bill for voice and data usage, as well as whether you or the employee owns the cell phone number in question. Above all, formalizing your BYOD policy should mean having all participants sign a written user’s agreement carefully drafted in consultation with a qualified attorney.

Year-end tax planning ideas for individuals

- ByPolk & Associates

- Oct, 03, 2022

- All News & Information

- Comments Off on Year-end tax planning ideas for individuals

It’s time to think about steps to lower your tax bill for this year and next. If you itemize deductions, you may be able to deduct medical expenses, state and local taxes up to $10,000, charitable donations and eligible mortgage interest. But these deductions won’t save taxes unless they’re more than your standard deduction ($25,900 for joint filers, $12,950 for singles and $19,400 for heads of household). You may be able to work around the deduction limits by bunching discretionary medical expenses and charitable donations into the year where they’ll do some tax good. For example, if you itemize for 2022 but not 2023, you may want to make two years of charitable contributions this year.

Work Opportunity Tax Credit provides help to employers

- ByPolk & Associates

- Oct, 03, 2022

- All News & Information

- Comments Off on Work Opportunity Tax Credit provides help to employers

In today’s tough job market and economy, the Work Opportunity Tax Credit (WOTC) may help business owners. The WOTC is available to employers that hire workers from targeted groups who face significant barriers to employment. The credit is worth as much as $2,400 for each eligible employee. The maximum credit amounts are different for some employees ($4,800, $5,600 and $9,600 for certain veterans; $9,000 for long-term family assistance recipients; and $1,200 for summer youth employees). The IRS recently issued information on the pre-screening and certification processes. A pre-screening notice must be completed by the job applicant and the employer on or before the day a job offer is made.

How to handle evidence in a fraud investigation at your business

- ByPolk & Associates

- Sep, 22, 2022

- All News & Information

- Comments Off on How to handle evidence in a fraud investigation at your business

Every business owner should be prepared to act if any indication of fraud arises. How you handle the evidence could determine whether you’ll be able to prove the charges brought against the alleged perpetrator. Place paper documents in a secure location and don’t mark them up. The fewer people who touch them, the better. Digital evidence generally presents more challenges. Train IT staff to respond quickly and appropriately when fraud is suspected. This includes stopping any routine data destruction immediately. Consider engaging a qualified forensic expert who can restore deleted and altered records, identify digital forgeries, and access password-protected files. Contact us for help.

Don’t forget income taxes when planning your estate

- ByPolk & Associates

- Sep, 22, 2022

- All News & Information

- Comments Off on Don’t forget income taxes when planning your estate

The current federal estate tax exemption ($12.06 million in 2022) means that many people aren’t concerned with estate tax. But they should still plan to save income taxes. For example, be careful making lifetime transfers of appreciated assets. It’s true that the assets and future appreciation generated by them are removed from your estate. But the gift carries a potential income tax cost because the recipient receives your basis upon transfer. He or she could face capital gains tax on the sale of the gifted property in the future. If the appreciated property is held until death, under current law, the heir will get a “step-up” in basis that will reduce or wipe out the capital gains tax.

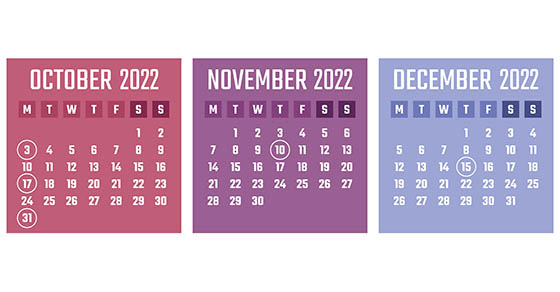

2022 Q4 tax calendar: Key deadlines for businesses and other employers

- ByPolk & Associates

- Sep, 22, 2022

- All News & Information

- Comments Off on 2022 Q4 tax calendar: Key deadlines for businesses and other employers

Here are some important 4th quarter tax-filing dates for businesses. OCT. 17: If you’re the owner or operator of a calendar-year C corp. which filed an extension, file a 2021 income tax return. OCT. 31: Report income tax withholding and FICA taxes for Q3 2022 (unless you’re eligible for a Nov. 10 deadline because you deposited on time and in full all of the associated taxes due). DEC. 15: If a calendar-year C corp., pay the fourth installment of 2022 estimated income taxes. Note: Certain deadlines may be postponed in federally declared disaster areas. We can provide more information about filing requirements and ensure you’re meeting all applicable deadlines.

Sometimes businesses need to show customers tough love

- ByPolk & Associates

- Sep, 14, 2022

- All News & Information

- Comments Off on Sometimes businesses need to show customers tough love

Every business needs customers or clients to survive. But to truly thrive, evaluate which customers support your company and which ones are dragging it down. There are many ways to do so. If your sales system tracks customer purchases, and your accounting system has good cost accounting or decision support capabilities, the process is simple. Companies that don’t track individual customers can still generally analyze customer segments or products. After you’ve assigned profitability levels to each customer or customer segment, sort them into an A group of optimal customers, a B group of acceptable ones, and a C group that aren’t profitable and you might want to let go. Contact us for help.

Seller-paid points: Can homeowners deduct them?

- ByPolk & Associates

- Sep, 14, 2022

- All News & Information

- Comments Off on Seller-paid points: Can homeowners deduct them?

The National Association of Realtors reports that July 2022 existing home sales were down but prices were up nationwide, compared with 2021. If you’re a homebuyer, you may wonder if you can deduct mortgage points paid on your behalf by the seller. The answer is “yes,” subject to some important limits. For example, the rule allowing a deduction for seller-paid points doesn’t apply to points that are allocated to the part of a mortgage above $750,000 ($375,000 for married filing separately) for tax years 2018 through 2025 (above $1 million for tax years before 2018 and after 2025). It also doesn’t apply to points on a loan used to improve (rather than buy) a home and in other situations.